3139 views

3139 views Certainly! Here’s a step-by-step guide on how to create your first GST invoice in your system:

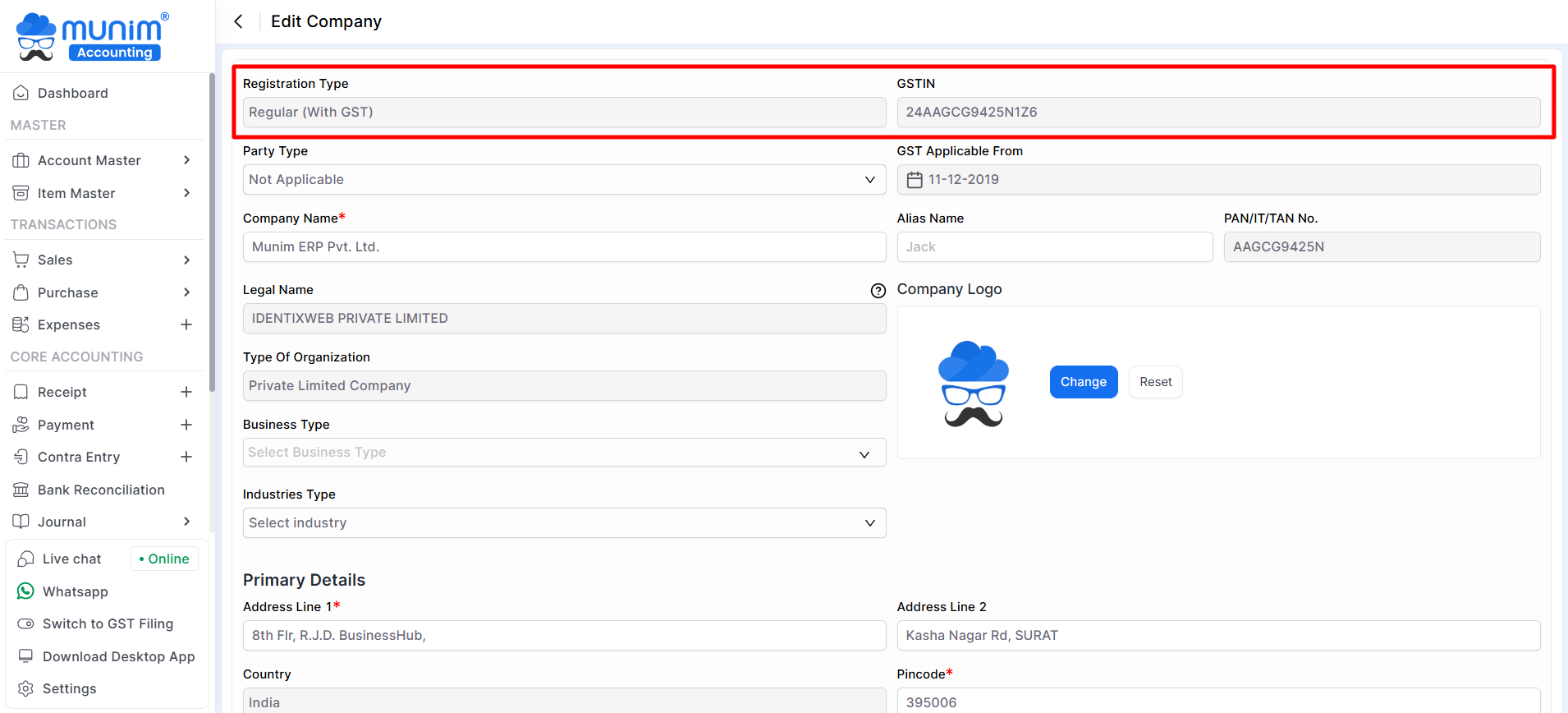

Step 1: GST Registration

- Ensure that your company is GST registered. If not, navigate to Settings, then Company and select the registration type as “Regular (with GST).” Fill in your GST number.

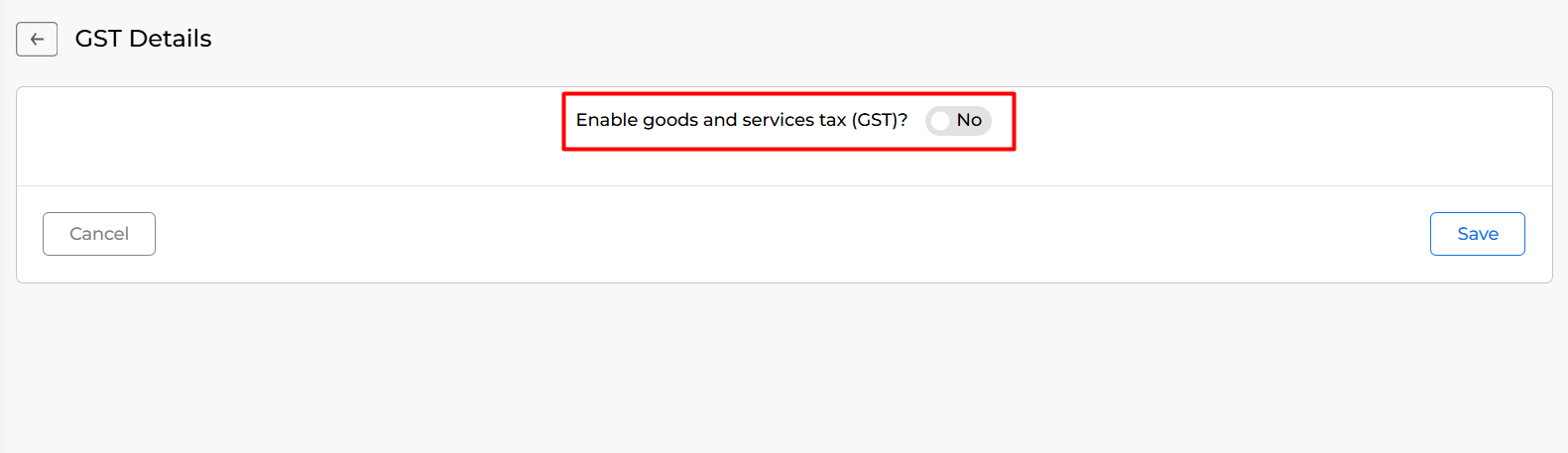

Step 2: Verify GST Settings

- Check your GST settings by going to “Settings > Statutory Information > GST Details.”

- The GST option should be enabled. If not, mark the “Enable goods and service tax(GST)?” option as “Yes” to enable GST features in the system.

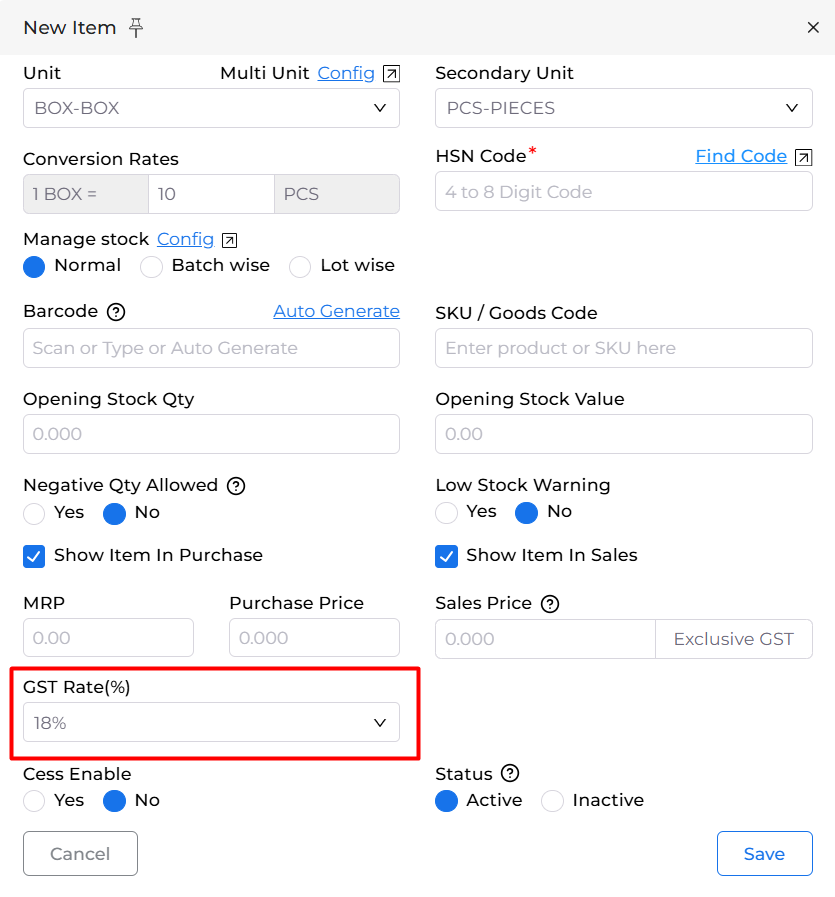

Step 3: Create Items with GST%

- While creating Items, add their applicable GST Rate percentages. This information will be used in the auto-filling process during invoice creation.

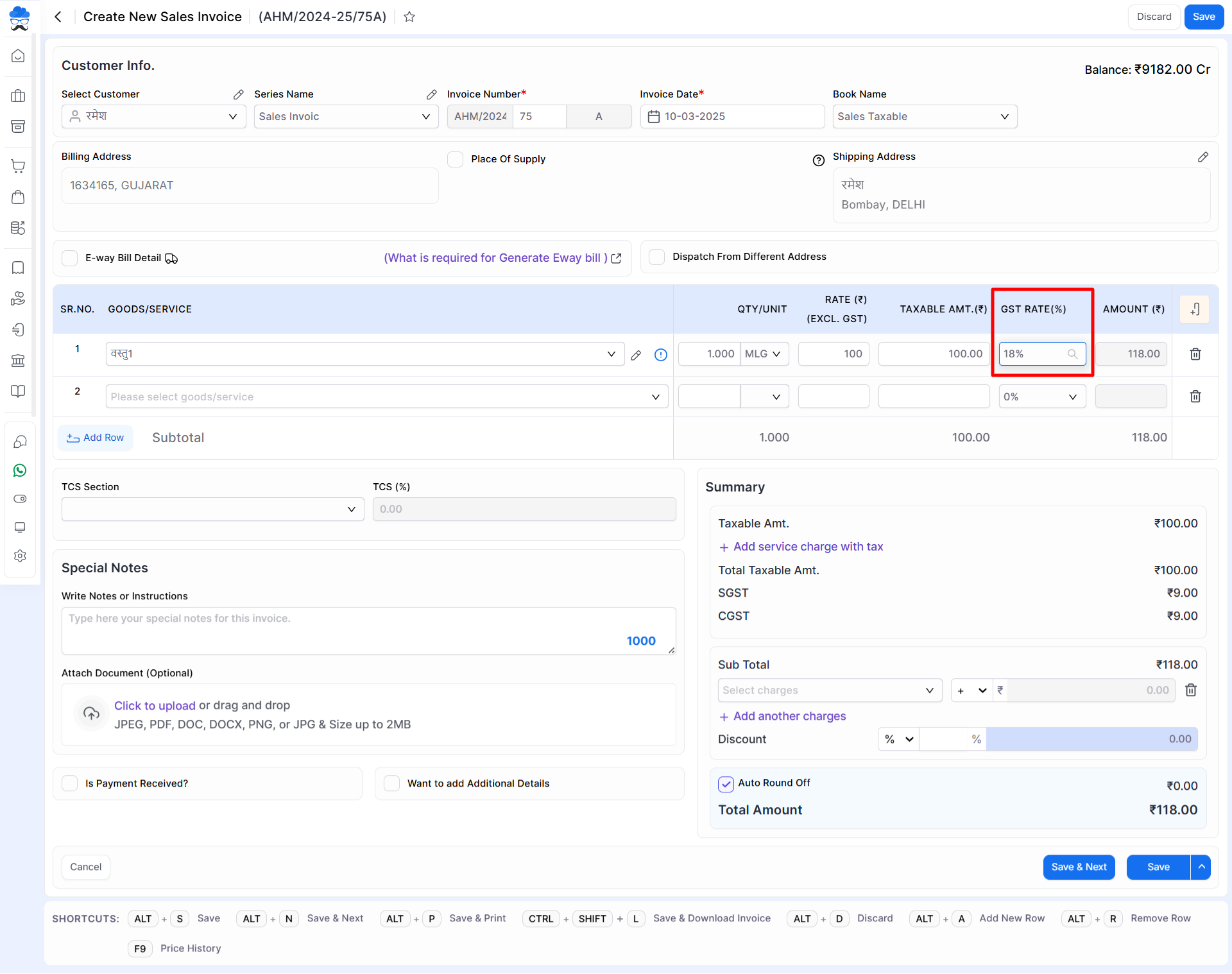

Step 4: Create Your GST Invoice

- When you’re ready to create an invoice, follow these steps:

- a. Navigate to the invoice creation section in your system.

- b. Select the items you want to include in the invoice. The GST% column will automatically populate based on the item details you’ve previously entered. You can also edit the GST rate from here.

- c. Verify that all other necessary details, such as customer information and invoice total.

Step 5: Save and Review

- Once you’ve filled in all the required information, save the invoice. Take a moment to review the details to ensure accuracy and completeness.

Note: While creating a Sales Invoice in past years, ensure that the Invoice date is already selected to get the GST Rate column.

Congratulations! You’ve successfully created your first GST invoice in the Munim Accounting Software. This process ensures that your invoices comply with GST regulations, making it easier for your business to manage taxation and maintain accurate financial records.