3138 views

3138 views Certainly! Munim Accounting & Billing software provides flexibility in adjusting item rate calculations to meet your preferences. This feature is available for Sales Invoice, Quotation and Delivery challan only. Here’s how you can make this change:

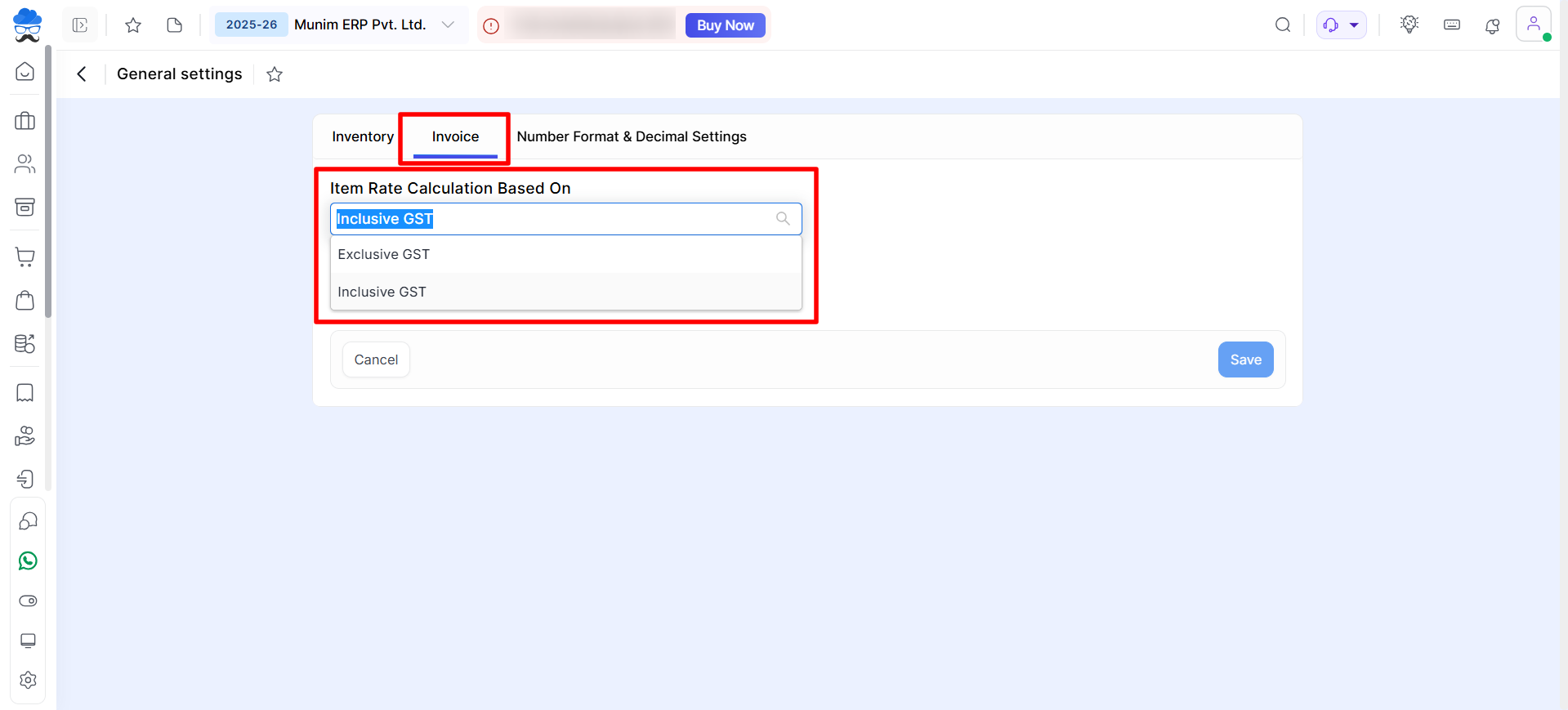

1. Navigate to Invoice Settings:

- Go to “Settings” in Munim. Within Settings, select “General Settings“

2. Choose Invoice Section:

- Under General Settings, find and click on the “Invoice” tab.

3. Adjust Item Rate Calculation:

- Locate the “Item Rate Calculation” field within the Invoice section.

4. Choose Rate Type:

- You have the option to switch between “Inclusive GST” or “Exclusive GST” rates based on your preference.

- After making your selection, remember to Save the changes.

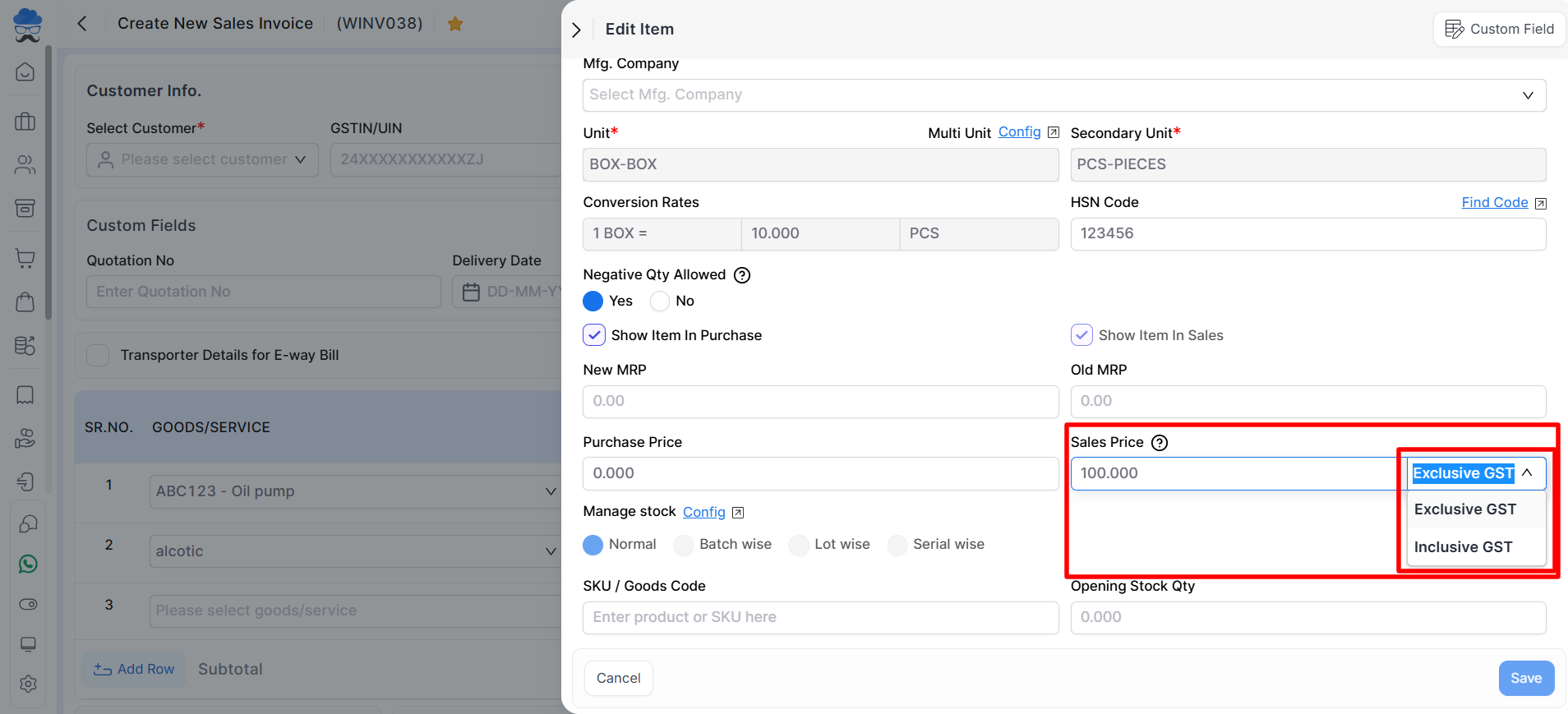

5. Item Rate Calculation Itemwise:

- Also, you have the option to configure item-specific rate calculations. During item creation, you can specify whether the sales rate should be inclusive or exclusive of taxes.

- So, when generating invoices, the system will automatically adjust the rates based on the calculation method selected for the individual item and within the sales invoice settings.

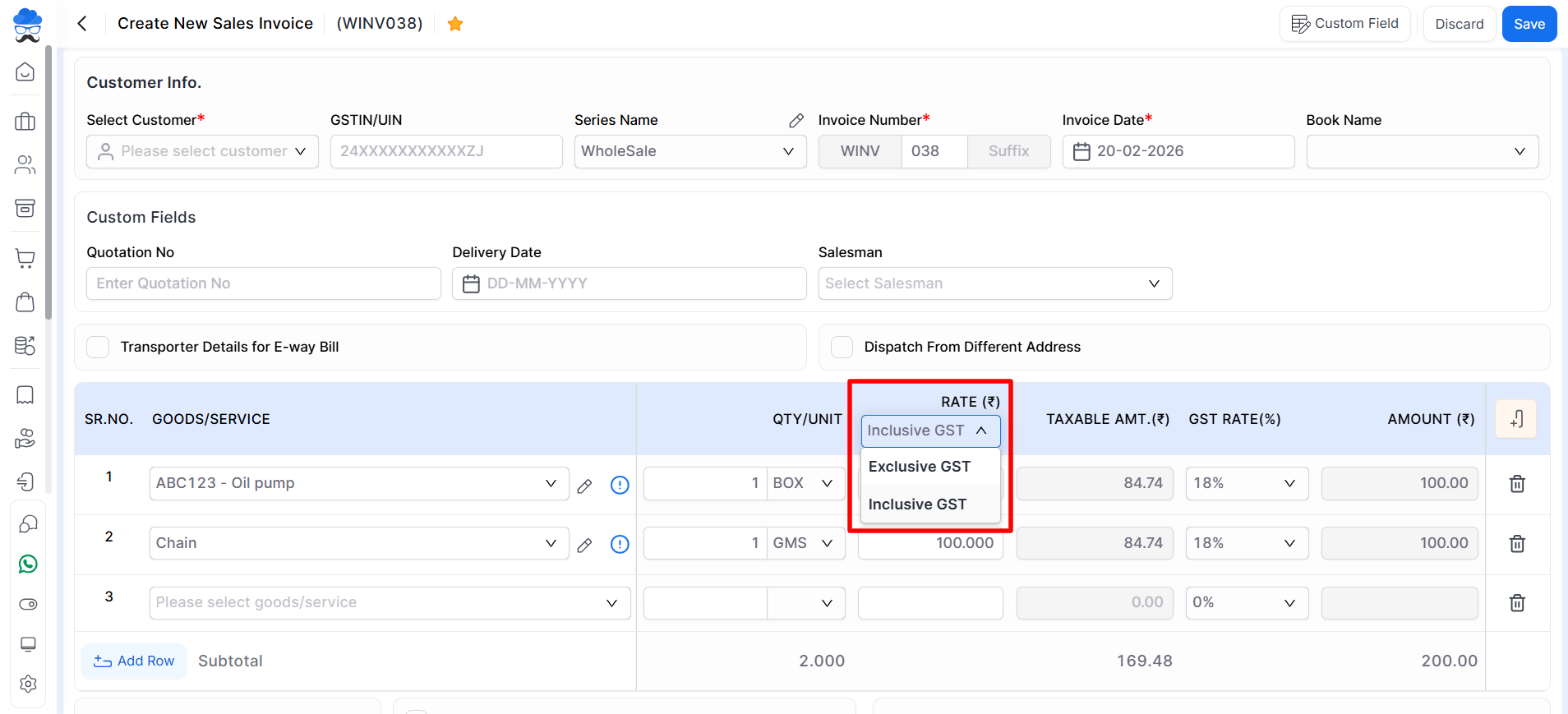

6. Effect on Invoice:

- After changing the Item Rate Calculation method, you will be able to see the difference accordingly while creating a Sales Invoice.

By following these steps, you can easily customise how item rates are calculated during invoice creation, ensuring that Munim adapts to your specific invoicing needs.