3357 views

3357 views Tax Deducted at Source (TDS) is a statutory requirement in India where a certain percentage of tax is deducted at the time of making specific expense payments, such as rent, contractor charges, professional fees, etc.

Munim allows you to configure and apply TDS directly in your accounts and transactions.

Follow the steps below to enable and use TDS in Munim:

Step 1: Enable TDS in General Settings

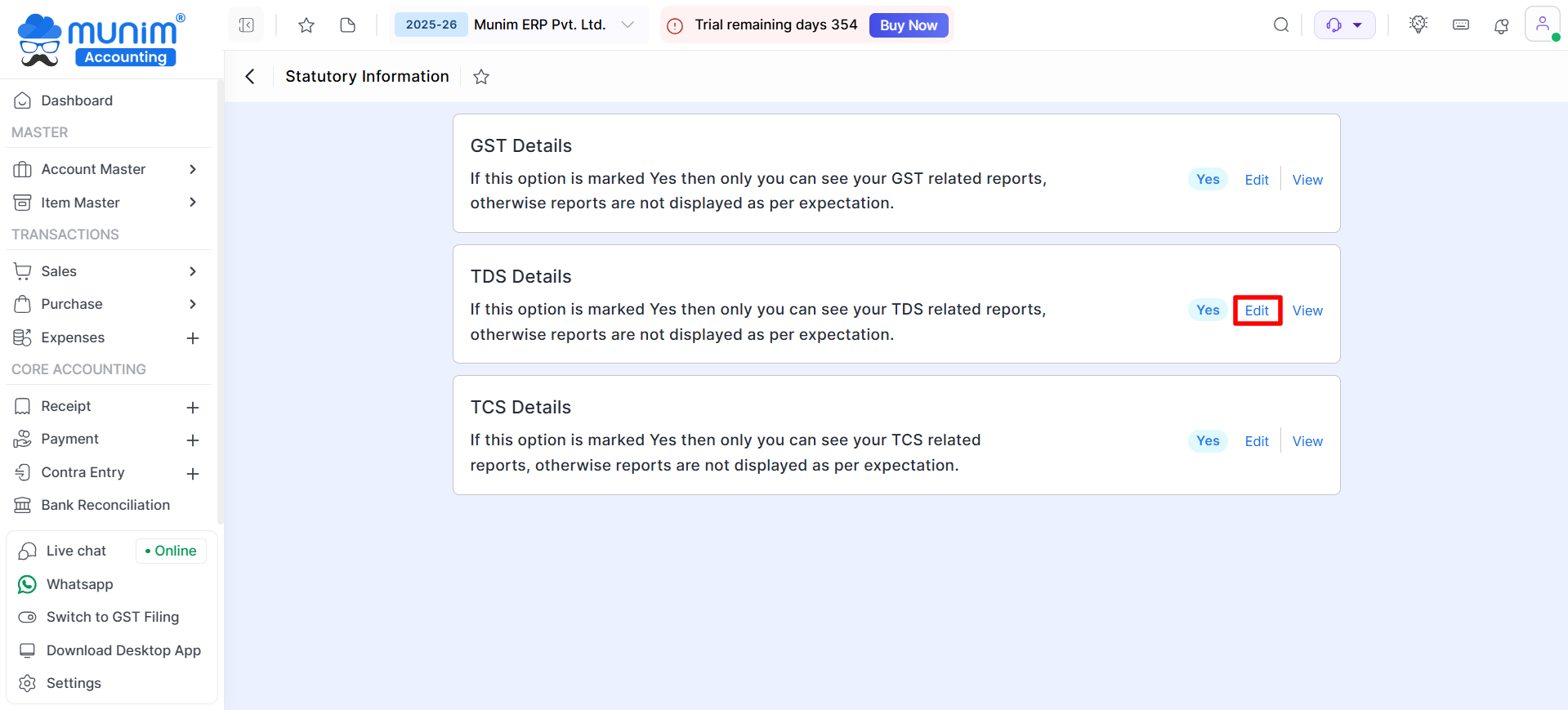

- Navigate to Settings > Statutory Information > TDS Details. Here, click on the Edit option.

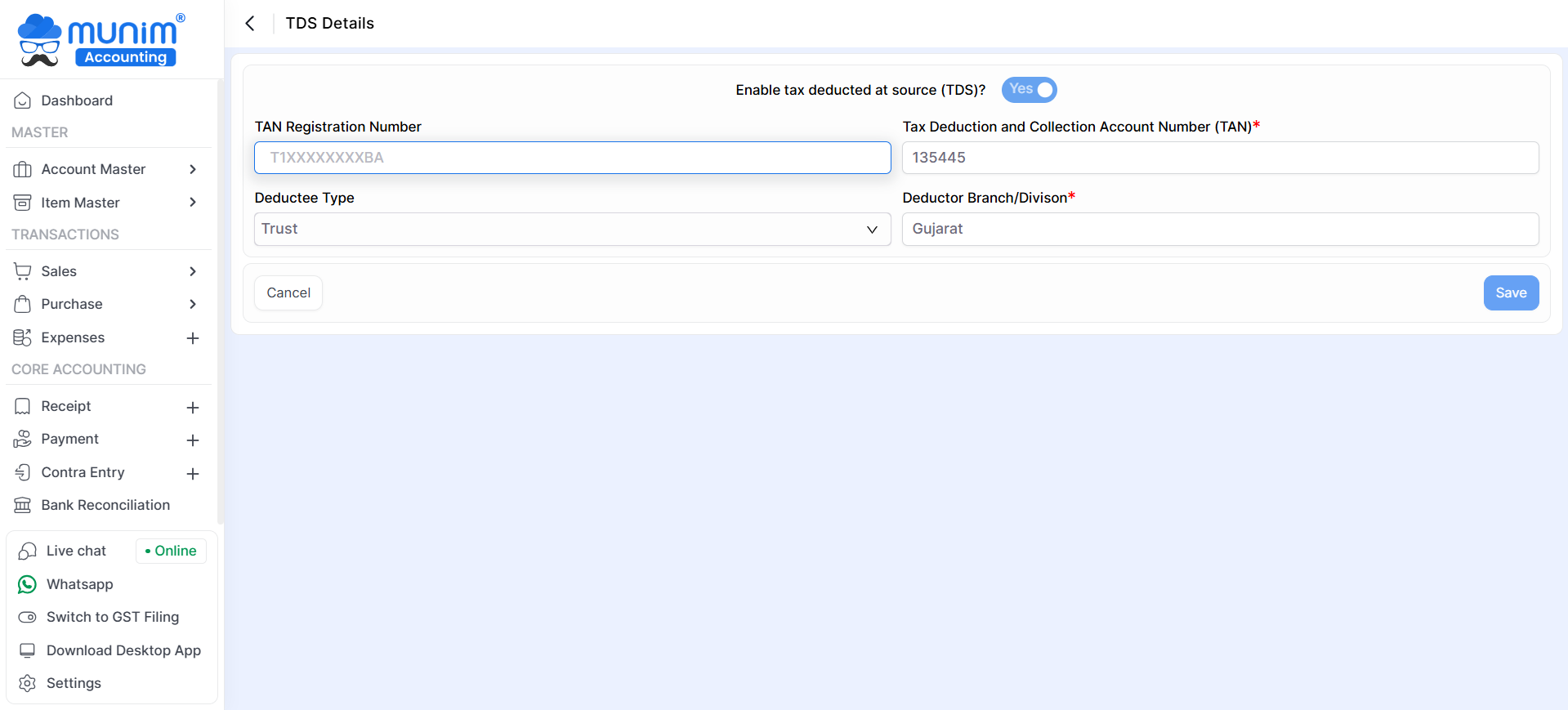

- In the edit mode, find the option Enable tax deducted at source (TDS)? and select Yes.

- Fill in the required statutory details such as TAN, Deductor Type, etc.

- Click Save to apply changes.

Step 2: Enable TDS for a Vendor

- Now you have to enable TDS for particular vendors. For that, Go to Account Master > Account.

- Find and click Edit for the respective vendor.

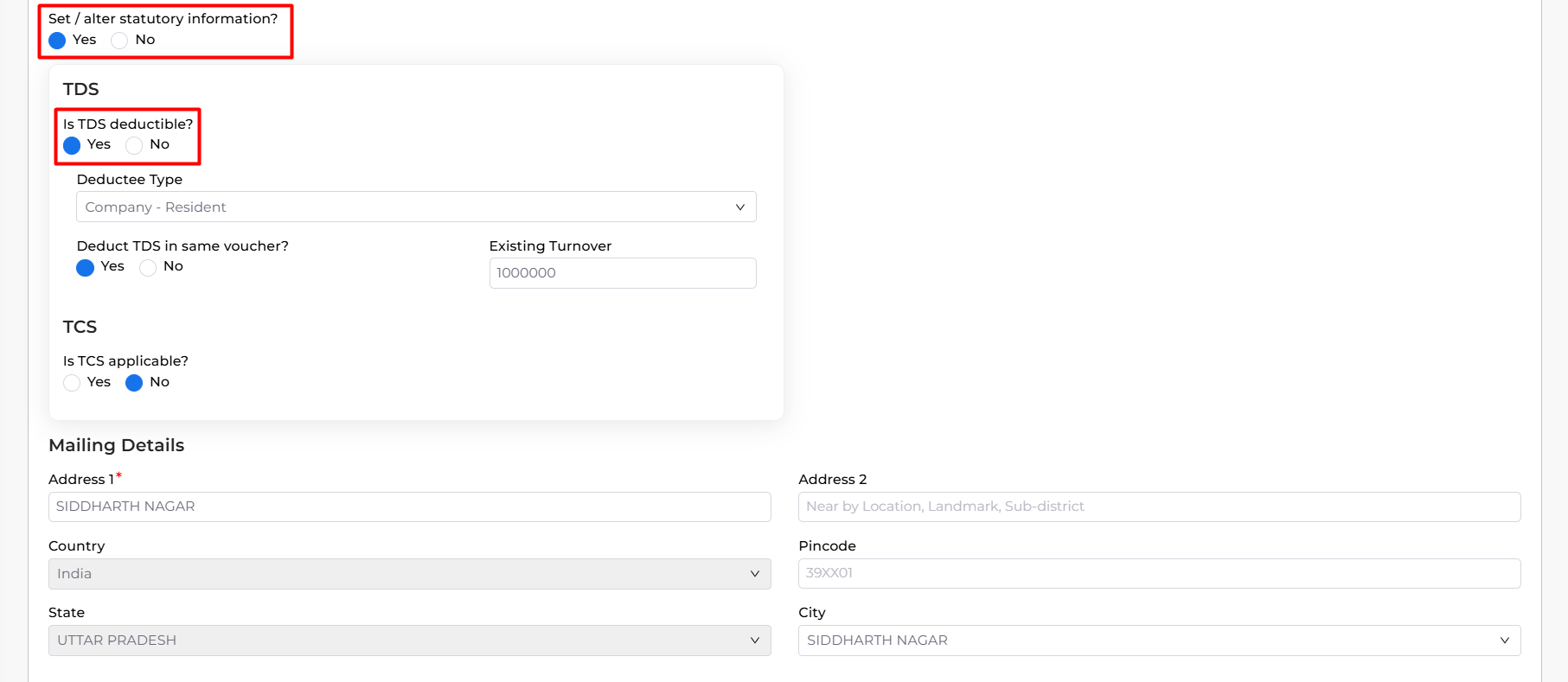

- In the statutory information section, enable Set / alter statutory information? by selecting Yes.

- Here, enable the option Is TDS deductible? by selecting Yes.

- Select the Deductee Type and enter the Existing Turnover (if applicable).

- Click Save to confirm.

Step 3: Apply TDS in Purchase Bills

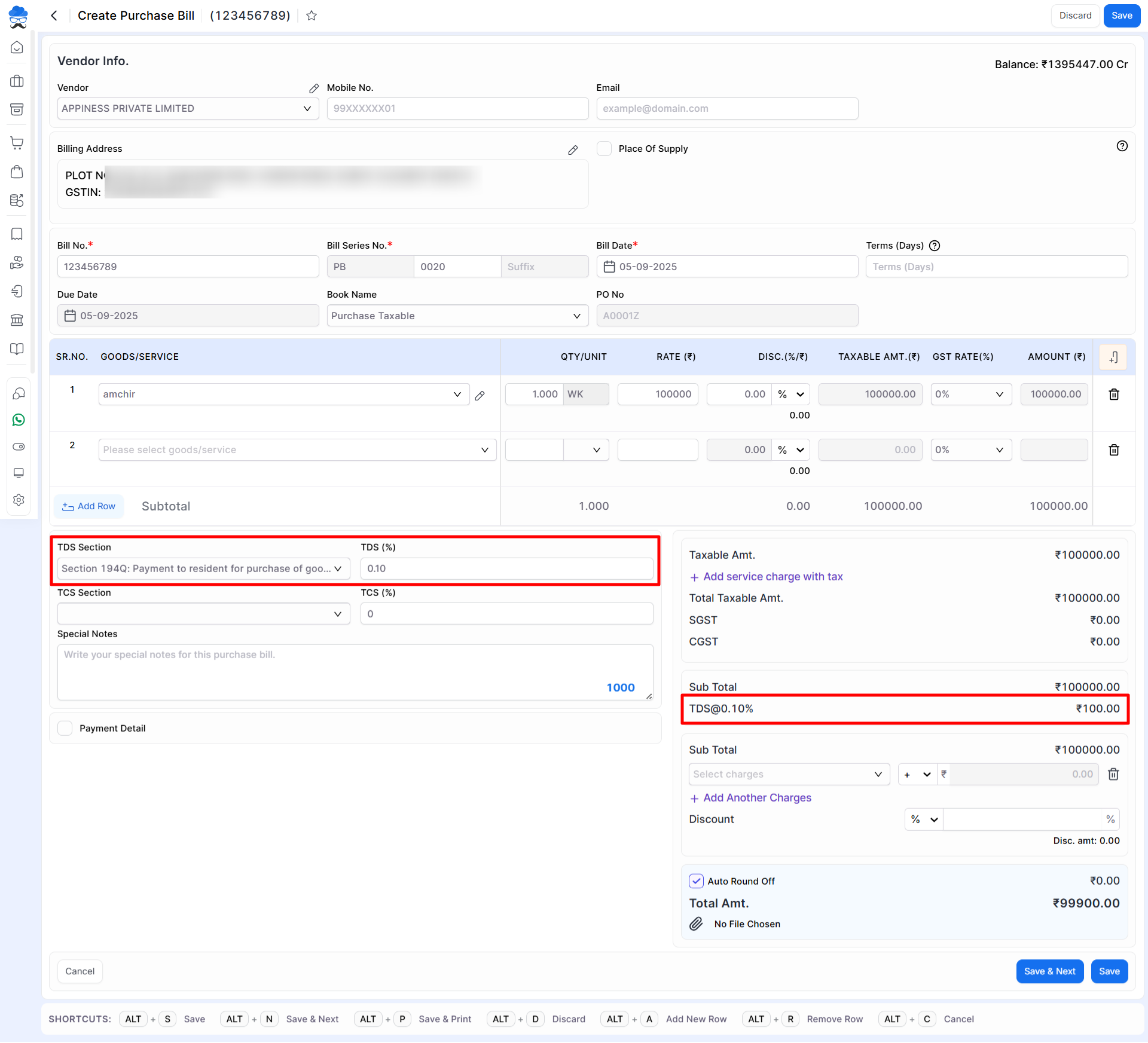

- While creating a Purchase Bill, select the TDS-enabled vendor.

- In the bill entry form, the default TDS section for Purchase Bill, 194Q will automatically apply the relevant TDS rate.

- TDS will be automatically calculated and reflected in the transaction. Save the bill.

- You can check its details in the TDS report in the Reports module.

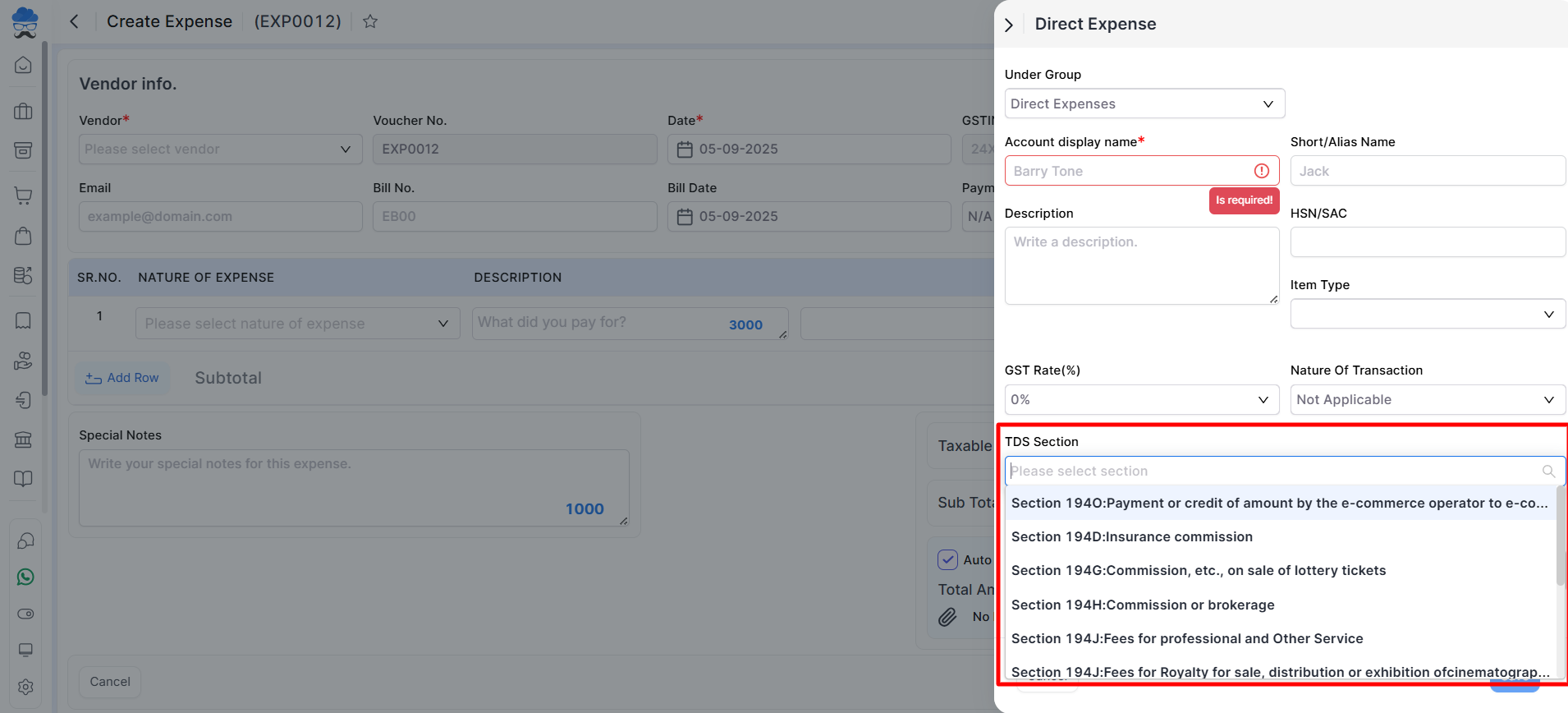

Step 4: Apply TDS in Expenses

- While creating an Expense, select the TDS-enabled vendor first.

- In the Expense selection field, click on +Add New Expense if you are creating a new expense type.

- In the Expense details, add required fields and go to the TDS section dropdown and select the valid section based on the type of expense.

- Save the entry. TDS will be calculated automatically for that transaction.

- You can check its details in the TDS report in the Reports module.

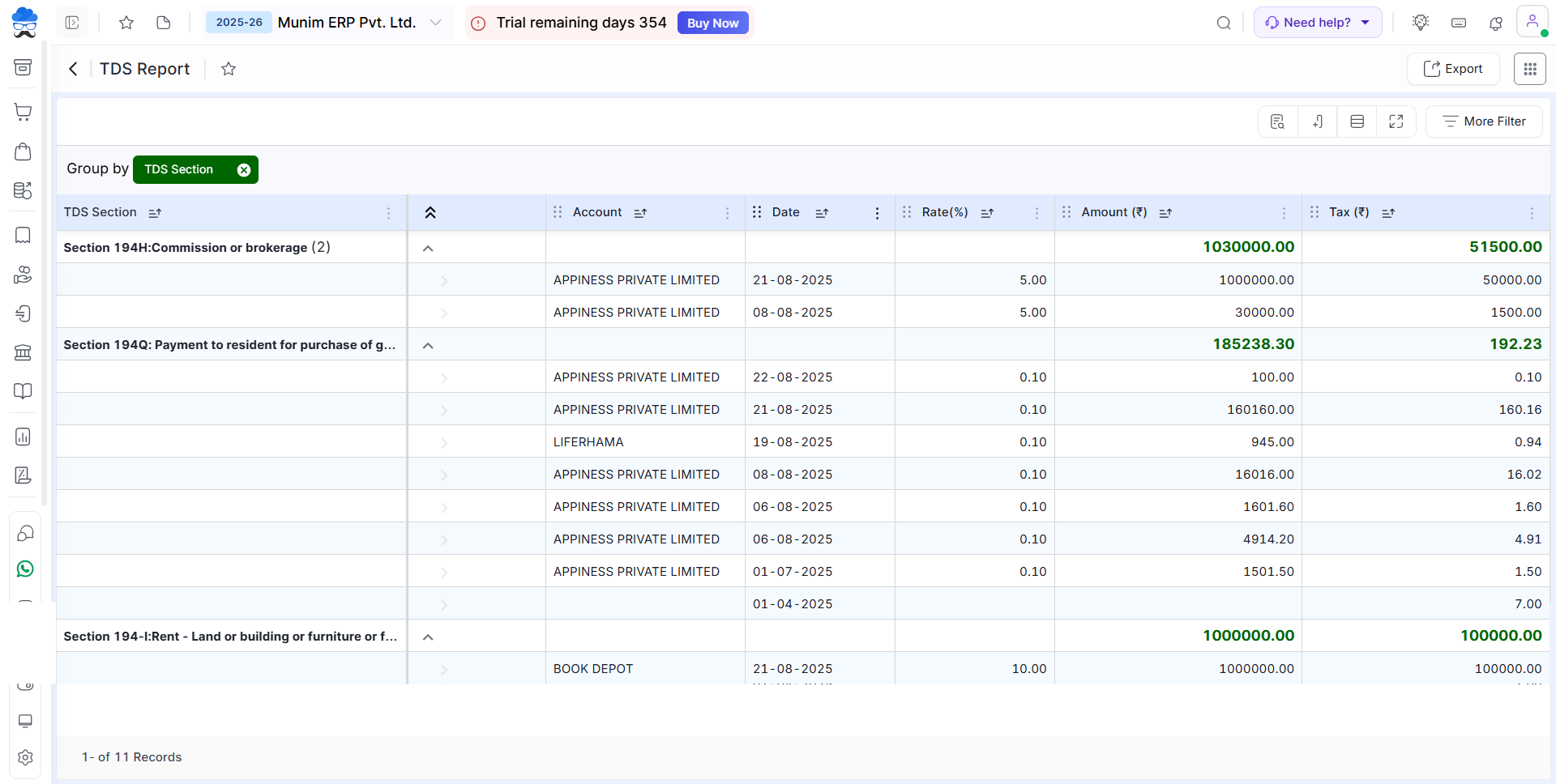

Step 5: View TDS Reports

- Navigate to Reports > Statutory Report > TDS Report.

- Here, you can view a detailed report of all TDS deductions, including vendor details, section, rate, and amount deducted.

Commonly Used TDS Sections (with Thresholds and Rate)

| Section | Nature of Payment | Threshold Limit | TDS Rate* |

|---|---|---|---|

| 194C | Payment to Contractors / Sub-contractors | ₹30,000 per contract or ₹1,00,000 aggregate per year | 1% (Individual/HUF), 2% (Others) |

| 194J | Professional or Technical Services | ₹30,000 per year | 10% |

| 194I(a) | Rent of Plant & Machinery | ₹2,40,000 per year | 2% |

| 194I(b) | Rent of Land, Building, Furniture | ₹2,40,000 per year | 10% |

| 194H | Commission or Brokerage | ₹15,000 per year | 5% |

| 194Q | Purchase of Goods | ₹50,00,000 (if purchase > ₹50 Lakh in a year) | 0.1% |

| 194A | Interest (other than securities) | ₹40,000 (₹50,000 for senior citizens) | 10% |

*The provided rates are illustrative and are subject to modification based on the most recent government notifications. It is essential to verify the rates prior to their application.

Important Notes

- Existing transactions remain unaffected; TDS applies only to new entries.

- Always cross-check the correct section and threshold before applying.

- If a vendor’s turnover is below the threshold, TDS will not be deducted.

- For multiple vendors, enable TDS separately in each account.

- Reports can be downloaded for filing and compliance.

By following these steps, you can fully comply with TDS requirements while managing accounts in Munim. For additional assistance, reach out to Munim support.