2848 views

2848 views The “Place of Supply” is a significant enhancement to our GST software. It is a fundamental concept in the GST framework, determining the applicable state GST for any transaction. Place of supply guidelines ensure tax revenue goes to the state where goods or services are consumed.

GST is a destination-based tax, meaning goods and services are taxed at the point of consumption, not origin. Therefore, GST collection authority lies with the state where goods/services are consumed.

The place of supply is crucial under GST, serving as the central point for all its regulations. The supplier’s location determines if a transaction is intrastate or interstate, affecting the applicable SGST, CGST, and IGST amounts.

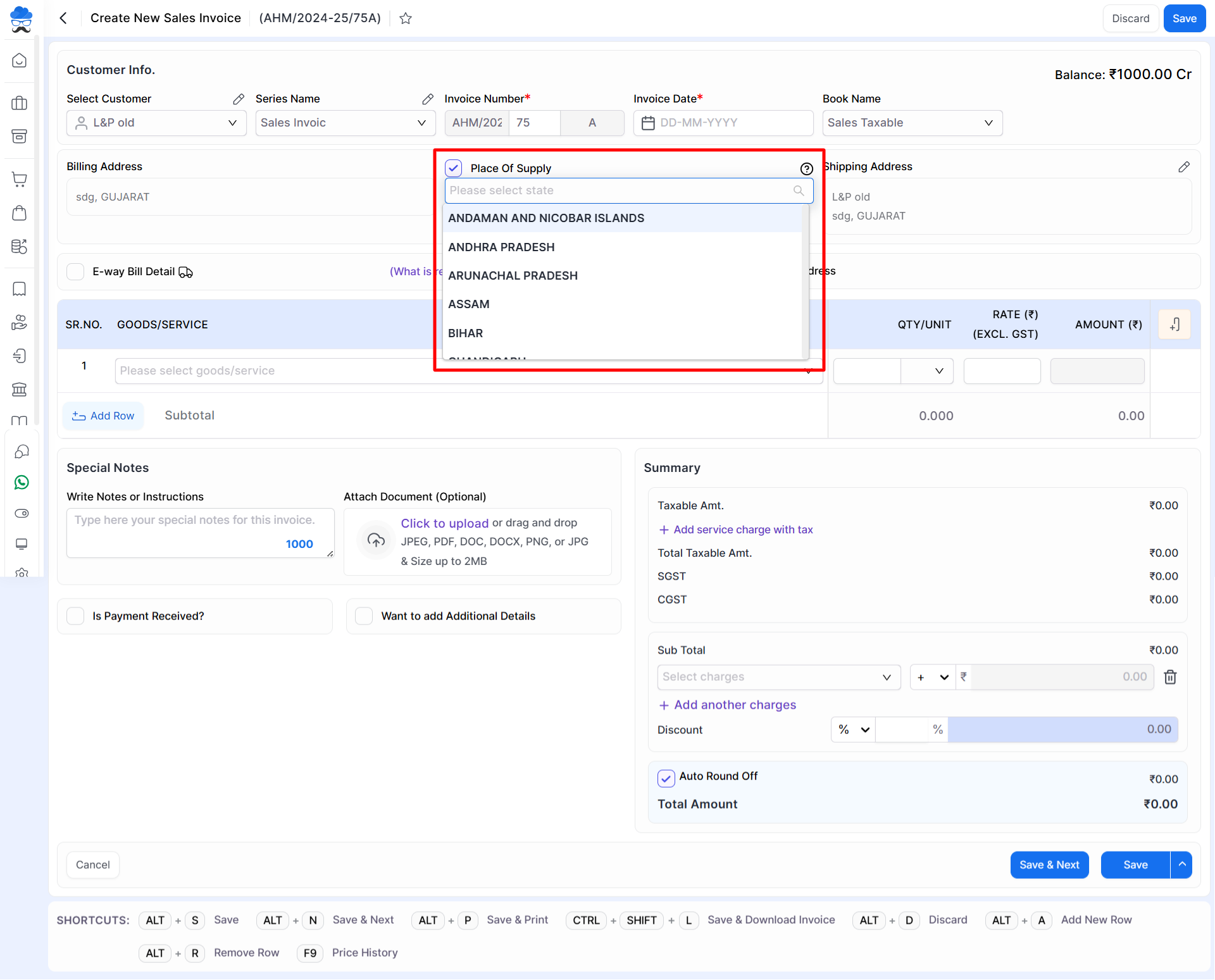

How to add Place of Supply in Sales Invoice:

- First, go to the Sales Invoice module in the left sidebar.

- Click on the Create Invoice button or press the Alt+N key.

- Select the Customer for creating the invoice.

- Click on the “Place of Supply” checkbox button. Select the State in the drop-down list.

Let’s have a look at some Examples:

Example 1- Intra-state sales – Seller Mr Anant of Surat, Gujarat sells 10 Laptop sets to Buyer Mr Purvesh of Vadodara, Gujarat (Gujarat to Gujarat)

- The place of supply is Vadodara in Gujarat. Since it is the same state, Gujarat, for both parties, CGST & SGST will be charged.

Example 2- Inter-state sales – Seller Mr Anant of Surat, Gujarat sells 25 Laptop sets to Buyer Mr Dharmesh of Mumbai, Maharashtra (Gujarat to Maharashtra)

- The place of supply is Mumbai in Maharashtra. Because the seller and buyer are located in different states, IGST will be charged.

Example 3- Deliver to a 3rd party as per instruction, Buyer Tejash in Lucknow (UP) buys goods from Seller Mr Anant in Surat (Gujarat). The buyer requests the seller to send the goods to Vadodara (Gujarat)

- In this case, it will be assumed that the buyer in Lucknow has received the goods & IGST will be charged. So Place of supply: Lucknow (UP) GST: IGST

Following these steps allows you to integrate the Place of Supply function into sales invoice creation, leading to improved regulatory compliance.

If you encounter any issues or have questions, check our helpdesk or reach out to the support team for further assistance.