2534 views

2534 views The Trading and profit and loss (P&L) report summarises the revenues, costs, and expenses incurred during a specific period of time. A P&L report provides information about whether a company can generate profit by increasing revenue, reducing costs, or both.

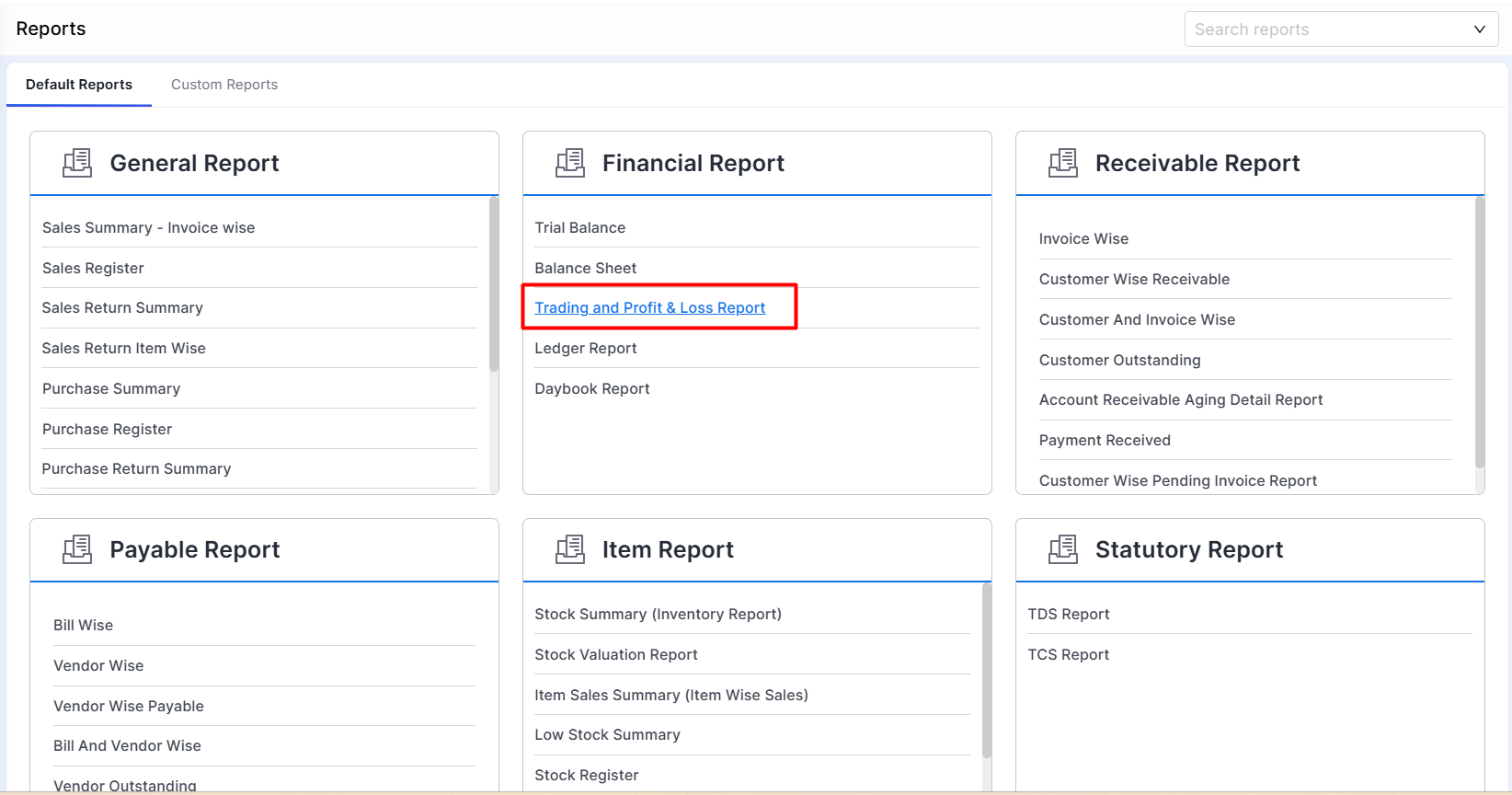

How to open Trading and Profit and Loss Report:

- Go to the Report module in the left sidebar.

- Click on the Trading and Profit and Loss Report option in the Financial Report section.

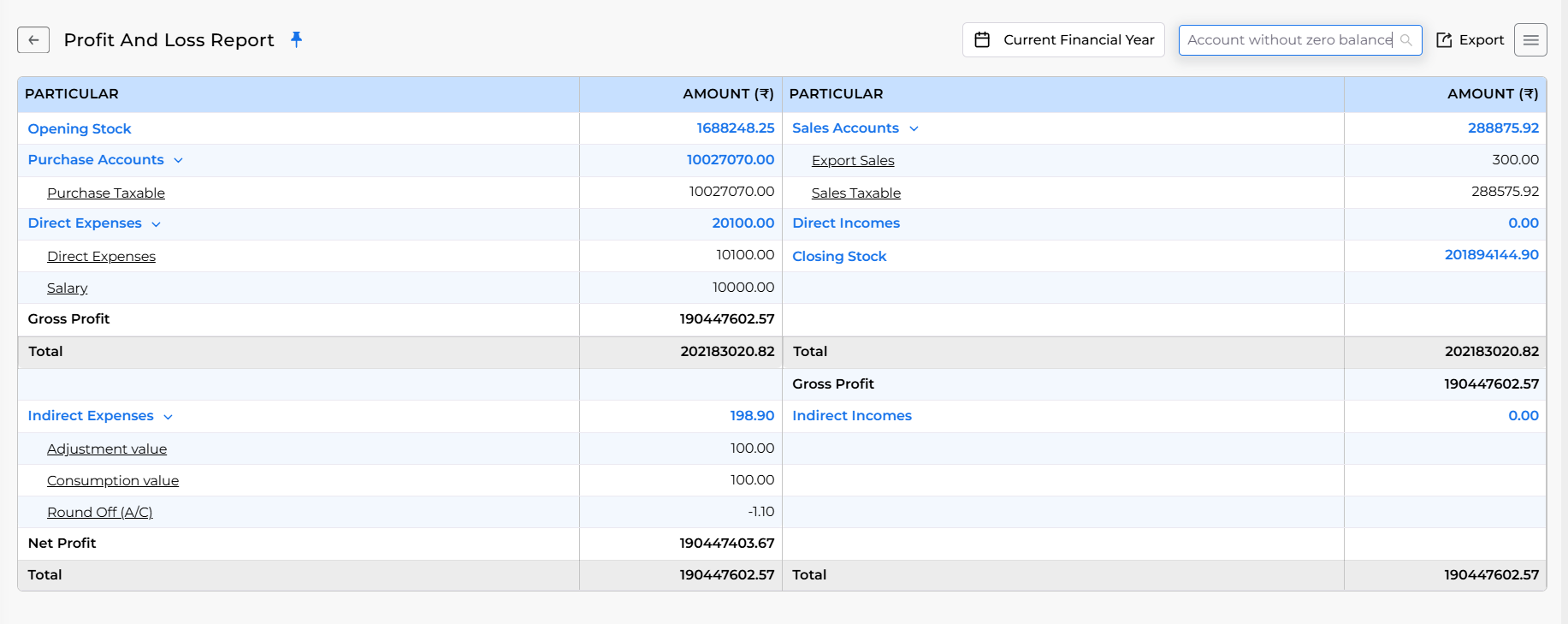

- Here you can click the Default View option to select from many options like expand every Undergroup to show all Accounts under it.

- Now, the user is able to Download or Email the Trading and profit and loss report in Excel and PDF format by clicking on the Export option.

- Also, users can select a custom date range for the Profit and Loss report by clicking on the Current Financial Year option.

It summarises the income, expenses, and profit/loss of a business during a financial year. It is divided into two main parts:

- Trading Account (Upper Part)

- Profit & Loss Account (Lower Part)

Let’s take a closer look at this report to understand it better.

1. Trading Account (Upper Half)

This part helps to determine the Gross Profit or Loss of the business.

Left Side (Debits – Costs – Expenses)

- Opening Stock: Inventory available at the beginning.

- Purchase Accounts: Cost of goods purchased for resale.

- Direct Expenses: Expenses directly tied to production or purchase like freight, wages, salaries.

Right Side (Credits – Revenue – Incomes)

- Sales Accounts: Revenue from sales (like Export Sales and Sales Taxable).

- Closing Stock: Inventory still available at the end of the period.

- Direct Incomes: Income directly from the core business.

Gross Profit = Credits – Debits

2. Profit & Loss Account (Lower Half)

This section calculates Net Profit or Loss, considering indirect incomes and expenses.

Left Side (Indirect Expenses)

- These are not directly linked to production but necessary for running the business (e.g., salaries, admin expenses, discount allowed, round off).

Right Side (Indirect Incomes)

- Earnings from non-core activities. (e.g., discount received).