2970 views

2970 views GSTR-1 Amendment refers to the process of making corrections or changes to the details provided in the original GSTR-1 return. This feature allows businesses to correct any errors or update information related to outward supplies (sales) after the initial submission of the GSTR-1 form.

Key Points

- Correction of Errors: Amendments can be made to rectify any mistakes in invoice details, such as the wrong GSTIN, incorrect invoice number, or date.

- Addition of New Information: If any sales were missed in the original GSTR-1, they can be added through an amendment.

- Change in Taxable Value or Tax Amount: Adjustments can be made if there are discrepancies in the taxable value or tax amount reported.

- Period of Amendment: Amendments can be made for any tax period, but only once for each invoice in a given month.

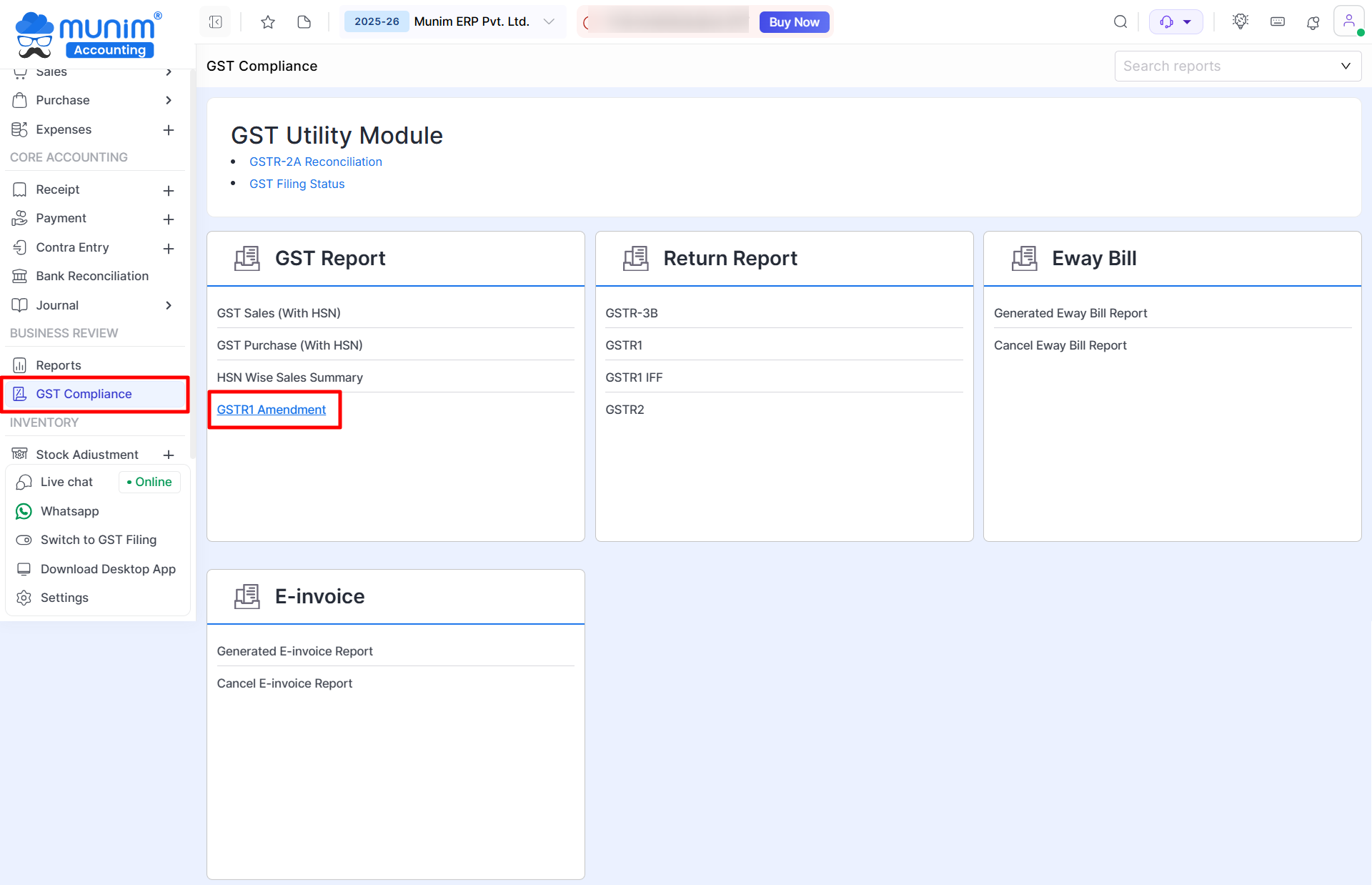

Locate to GSTR1 Amendment Report:

In the GST compliance Module, Under the GST Report Section, there is a GSTR1 Amendment Report available.

Here you can check the Amendment entries done by you after filing is done for a particular month.

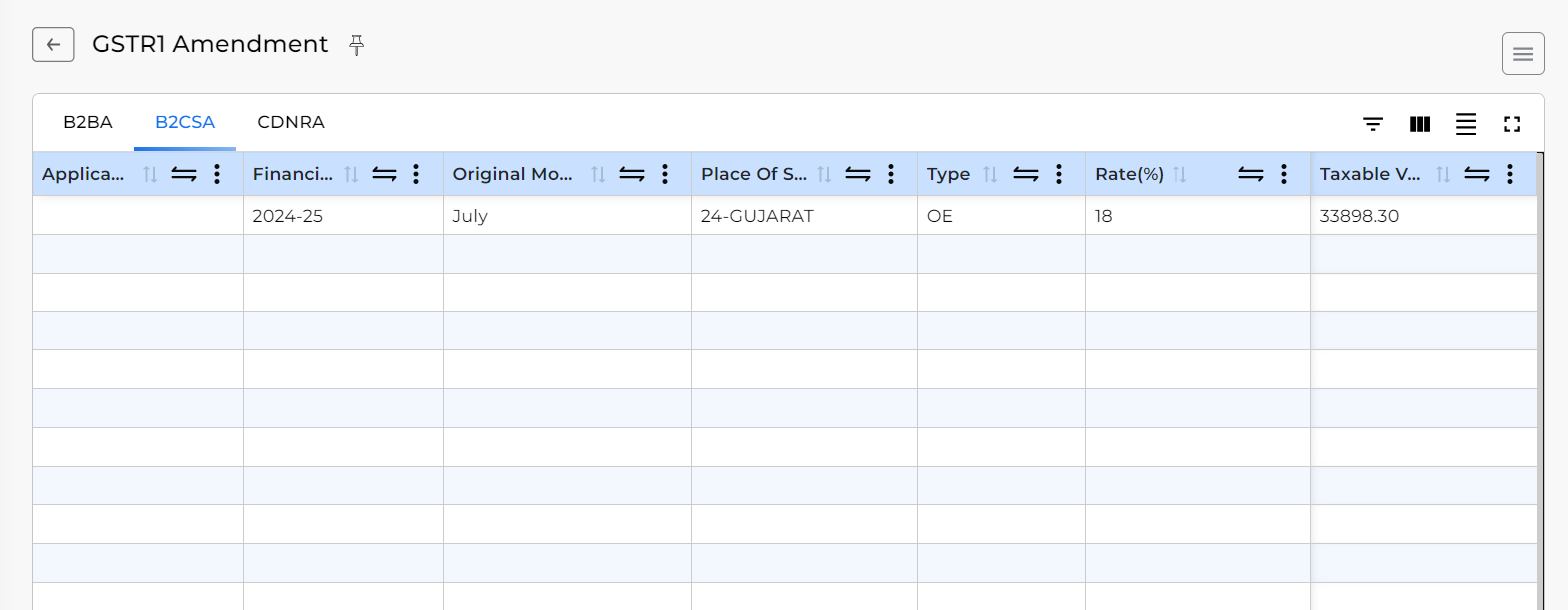

Here you will get 3 tabs named B2BA, B2CA and CDNRA.