3014 views

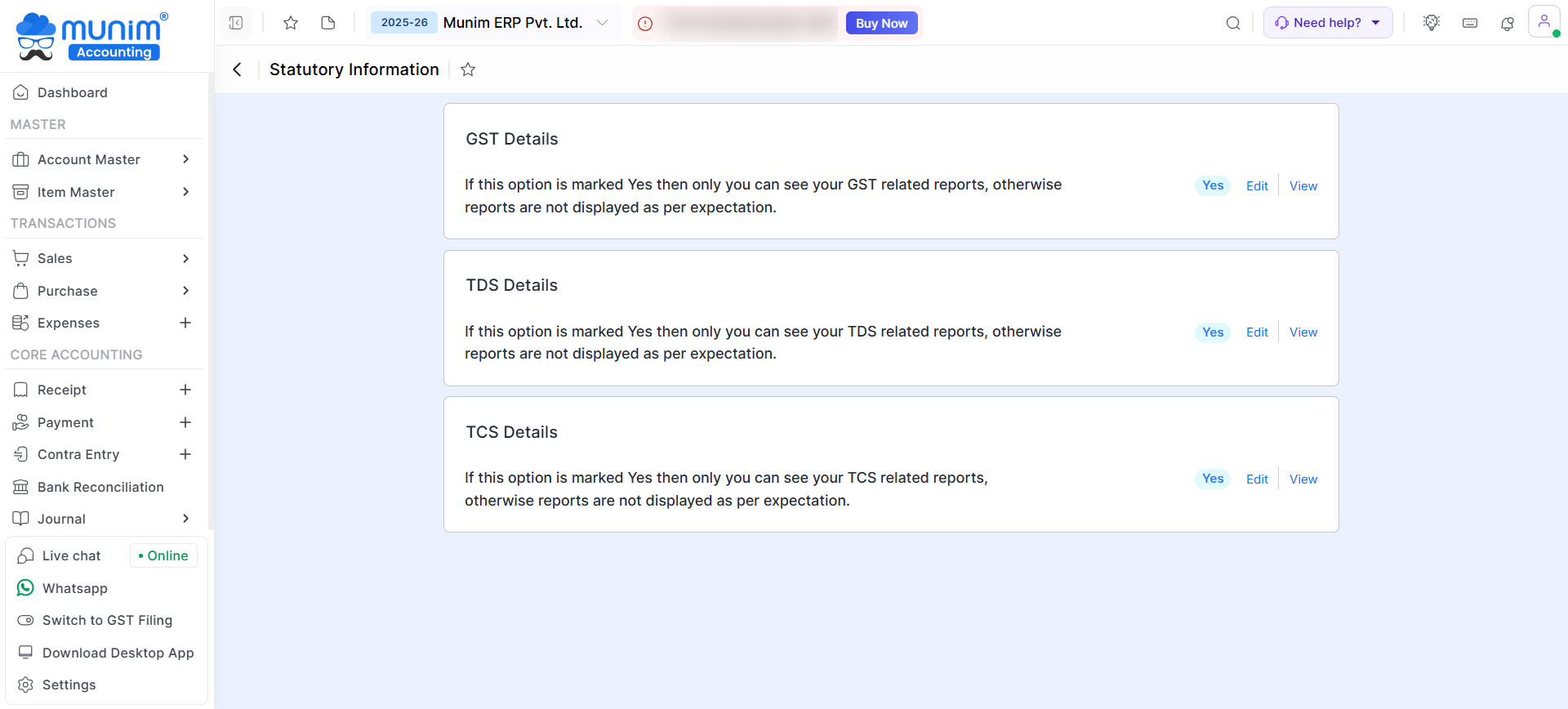

3014 views Here you are able to update company statutory information like GST details, TDS details, and TCS details. here are two options available to manage this module.

The first one is when creating a new company and saving that entry at that time pop-up display for Do you want to add Statutory Info? if yes then you will redirect to the statutory info onboarding form.

The second one is to go to the settings module and click on the Statutory Information button.

Here you will get three options. First, select the GST Details option by clicking on Edit.

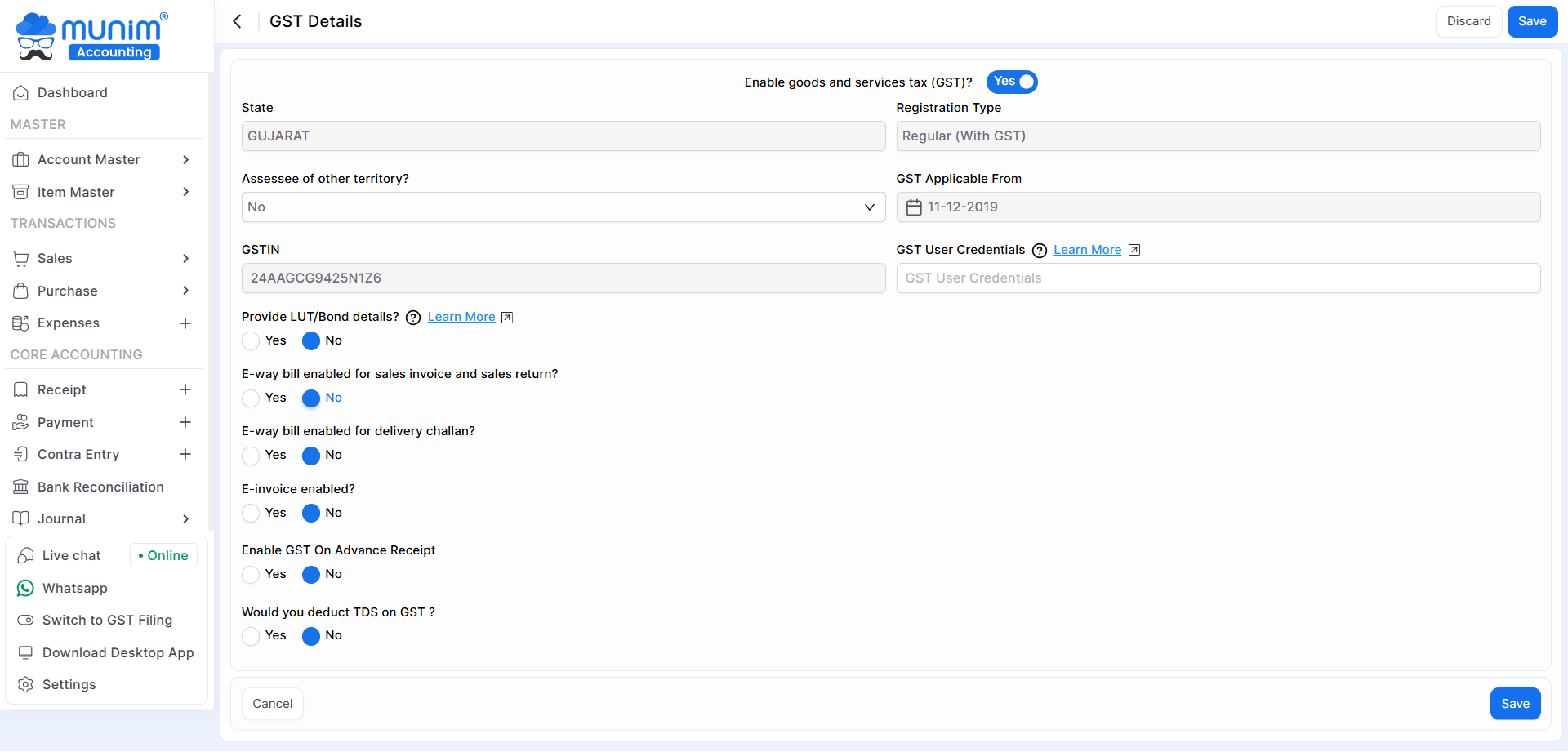

Here, you will get many options with GST company details.

If you enter a valid GSTIN in the company master, then it will auto-fetch the State, Registration type, GST applicable from, and GSTIN/UIN information from the GST portal. The GST user credentials are compulsory if you want to use the GSTR2A reconciliation process.

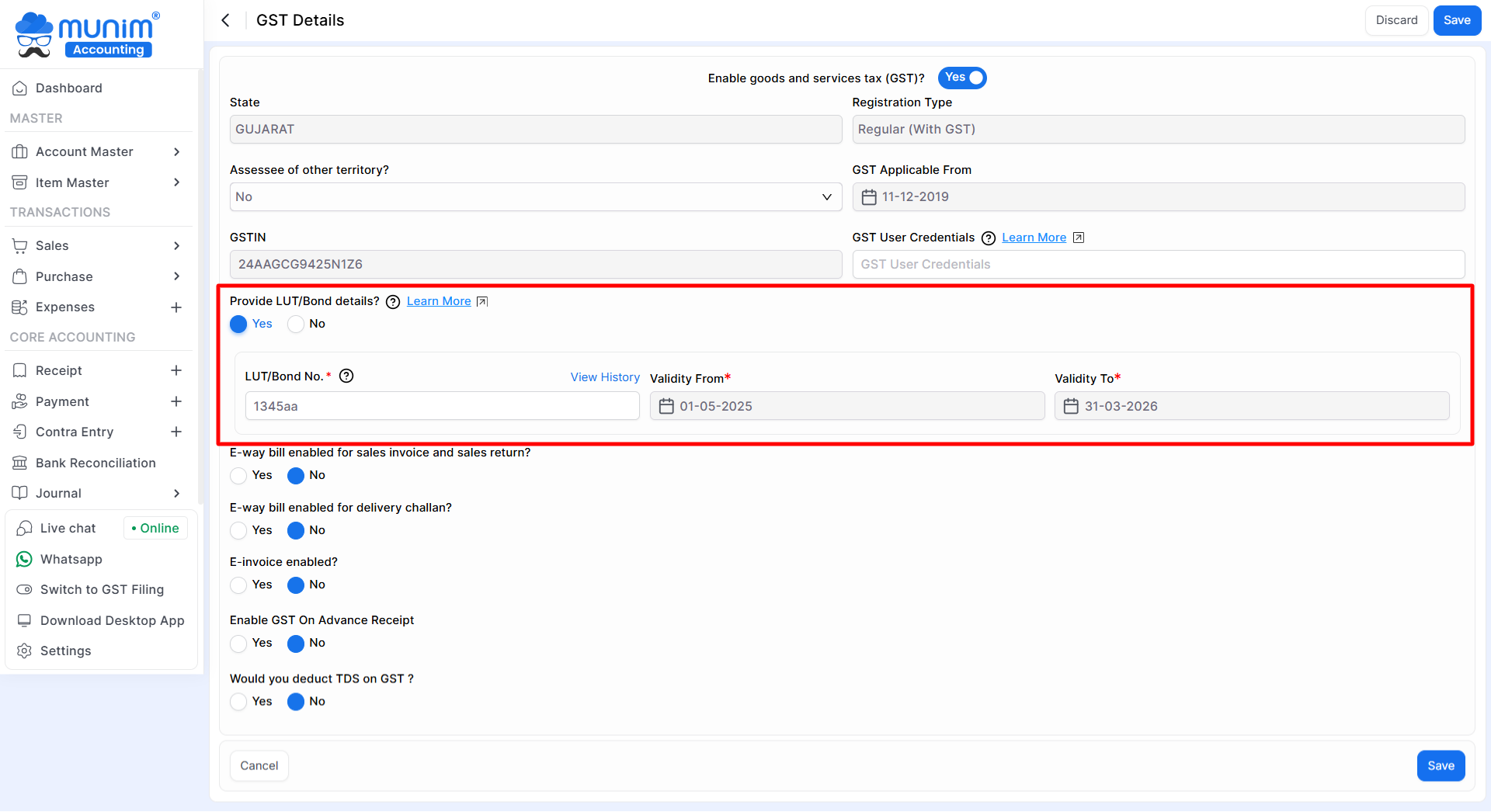

Here, Provide LUT/Bond details? If Yes then

This information is used in the Sales Invoice print if you are creating an Export Sales Invoice.

What are Letter of Undertaking (LUT) and Bonds?

Letter of Undertaking (LUT)

- It is a type of bank guarantee, under which a bank allows its customer to raise money from another Indian bank’s foreign branch as short-term credit. The purpose of such undertakings is to ensure that the owner of the ship or aircraft would:

- Employ security on the vehicle;

- Enter an appearance and acknowledge ownership;

- Pay any final decree entered against the vehicle, whether it is lost or not.

Bond

- It is a financial instrument in which the issuer of a bond owes the holders a debt and is obliged to pay them interest or to repay the principal at a later date. It is a highly secured and highly liquid financial instrument that is mostly negotiable. This means that the ownership of the bond can be transferred.

- The most common types of bonds are municipal bonds and corporate bonds. In case of furnishing bonds for exports, the general parlance is B-1 Surety / Security (General Bond) is furnished. These kinds of bonds have a surety (another person) who guarantees the performance on the part of the obligor (person furnishing the bond)

Who can use Letter of Undertaking (LUT) and Bonds for exports

- Any registered taxpayer exporting goods or services can make use of LUTs. However, any person who has been prosecuted for tax evasion for an amount of Rs. 2.5 Crores or above under the act is not eligible to furnish LUTs.

- The validity of such LUTs is for a period of one year (till the end of financial year). An exporter furnishing LUTs is required to furnish a fresh LUT for each financial year. If the conditions mentioned in LUT are not satisfied within the time limit, the privileges are revoked, and the exporter will have to furnish bonds.

- For all the other assesses (along with the ones who have been prosecuted for tax evasion of Rs. 2.5 Crores or above under the GST laws), bonds should be furnished if the export is being made without payment of IGST. The Letter of Undertakings can be furnished and submitted online through the GST portal.

- At the same time, the bonds are required to be furnished manually as the hard copy of the same has to be remitted to the department. Example of transactions for which LUT/Bonds can be used:

- Zero-rated supply to SEZ without payment of IGST

- Export of goods to a country outside India without payment of IGST

- Providing services to a client in a country outside India without payment of IGST

GST is applied under the following conditions:

- When the company GST statutory is enabled, GST is always applied to sales invoices, regardless of whether the customer has a GST number.

- GST has two parts IGST or CGST & SGST. it has different rules to apply them.

IGST Rules:

- If customer party type is SEZ and customer selected With payment of IGST and also Invoice date is between LUT from date and LUT to date, apply IGST.

- If customer party type is SEZ and customer not selected With payment of IGST, Do not applied any GST for that sales invoice.

- If customer party type is SEZ and LUT not apply or Invoice date is not between LUT from date and LUT to date, always apply IGST.

- If Exports sales book is selected and With payment of IGST is selected in show above book selection and also Invoice date is between LUT from date and LUT to date, apply IGST.

- If the Export Sales book is selected and With payment of IGST is not selected in the show above book selection, do not apply any GST for that sales invoice.

- If the Export Sales book is selected and LUT not apply or Invoice date is not between LUT from date and LUT to date, always apply IGST.

- Note : User could not select Exports sales book if Customer party type is SEZ.

- If the customer country is different from the country of selected company, apply IGST.

- If the shipping state is different from state of selected company, apply IGST.

CGST & SGST Rules:

- If the shipping state and the state of the selected company, then CGST & SGST.

Note: For GST, first check IGST rules if satisfy any rules, GST is applied according to them otherwise, check CGST & SGST rules.

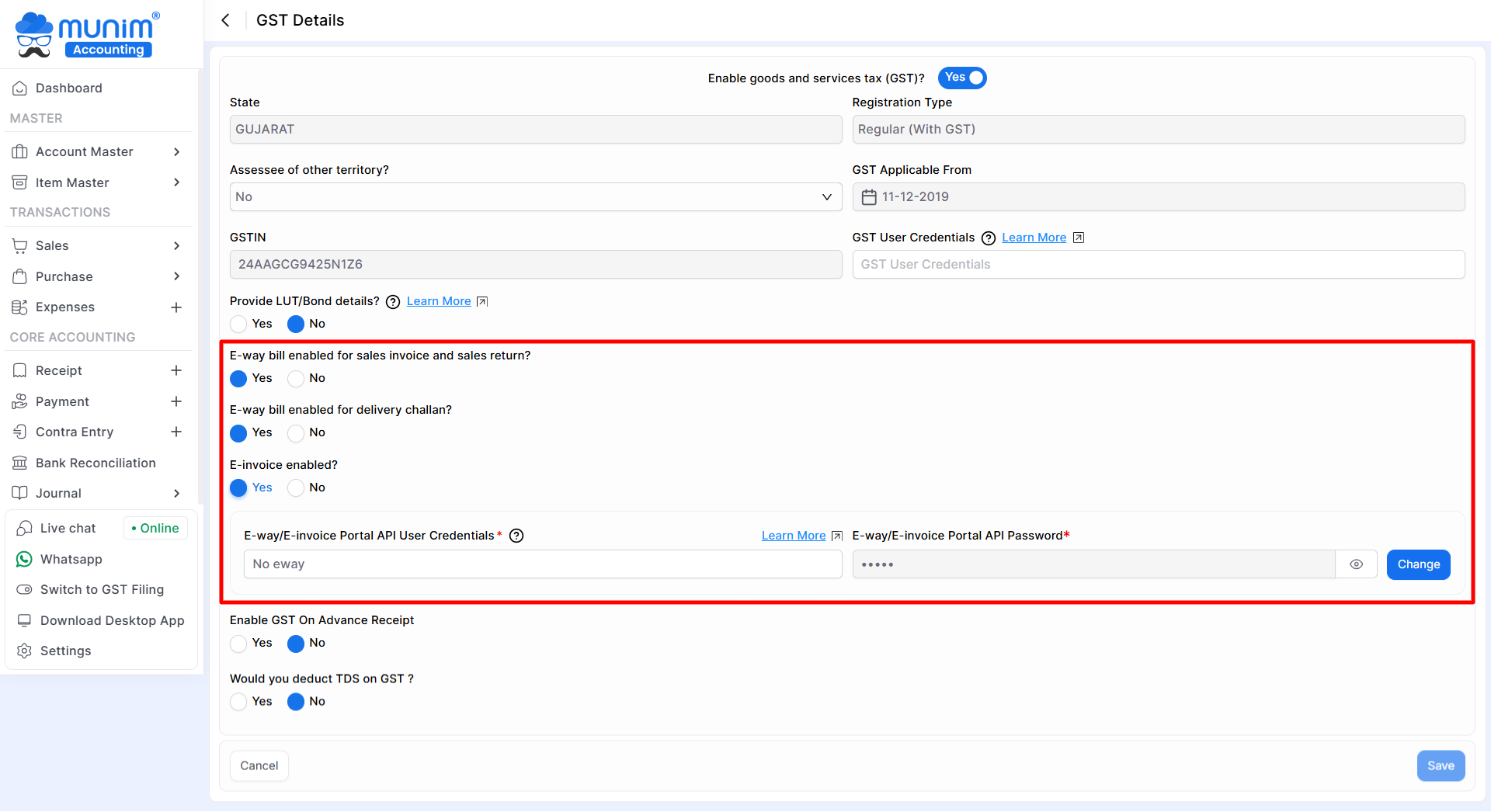

E-Way bill and E-Invoice enable options :

- Here you will get options like E-way bill enabled for sales invoice and sales return?, E-way bill enabled delivery challan? and E-invoice enabled.

- If the option is selected yes and enabled for E-way bill enabled for sales invoice and sales return?, E-way bill enabled delivery challan? It will ask for the E-way/E-invoice portal API username and password.

- If you do not have this, then please follow the steps below to generate it and then add this info here.

- Step 1: Log in to the Eway bill portal https://ewaybillgst.gov.in/login.aspx

- Step 2: After logging in to the above website, on the left side, click on Registration and select GSP

- After clicking on for GSP e-way bill portal will send the OTP to the mobile number and email id linked to that user.

- Step 3: After entering the OTP, click on ADD/NEW and through GSP, and in the drop-down list, select your GSP name “TERA SOFTWARE LIMITED”

- Step 4: Once you select TERA SOFTWARE LIMITED, you can create the user name and password.

- Step 5: The User name was already given by the portal, and you can enter only the last 3 digits. Password should be 12-15 digits

- Provide your E-way portal API username and E-way portal API password. This information will be used for your auto-eway bill generation from the software.

- If this option is Yes, then only Sales Invoice have Eway bill data and the Generate Eway pop-up option is displayed.

Here E-Invoice bill enabled? If Yes then

- If yes, then it will ask for the E-Invoice portal API username and password. Here you can also enter the eWay portal Api Username and Password,

- If you do not have this, then please follow the steps below to generate it and then add this info here.

- Step 1: Log in to https://einvoice1.gst.gov.in/

- Step 2: After logging in to the above website, on the left side, click on API registration

- API Registration User credentials: Create an API user

- After clicking on Create API user will receive OTP from the e-Invoice portal.

- After entering the OTP, click on through GSP and in the drop-down list select your GSP name “TERA SOFTWARE LIMITED”

- Once you select TERA SOFTWARE LIMITED, you can create the username and password.

- User name was already given by the portal as API_

- So always the user name starts with API_

- Provide the E-Invoice portal API username and E-Invoice portal API password. This information will be used for your auto E-Invoice generation from the software.

- If this option is Yes, then only Sales Invoice have Eway bill data and the Generate E-Invoice /Eway pop-up option displays.

Enable GST on advance receipt

- Here, Enable GST on the advance receipt is used for the GSTR1 amendment entry.

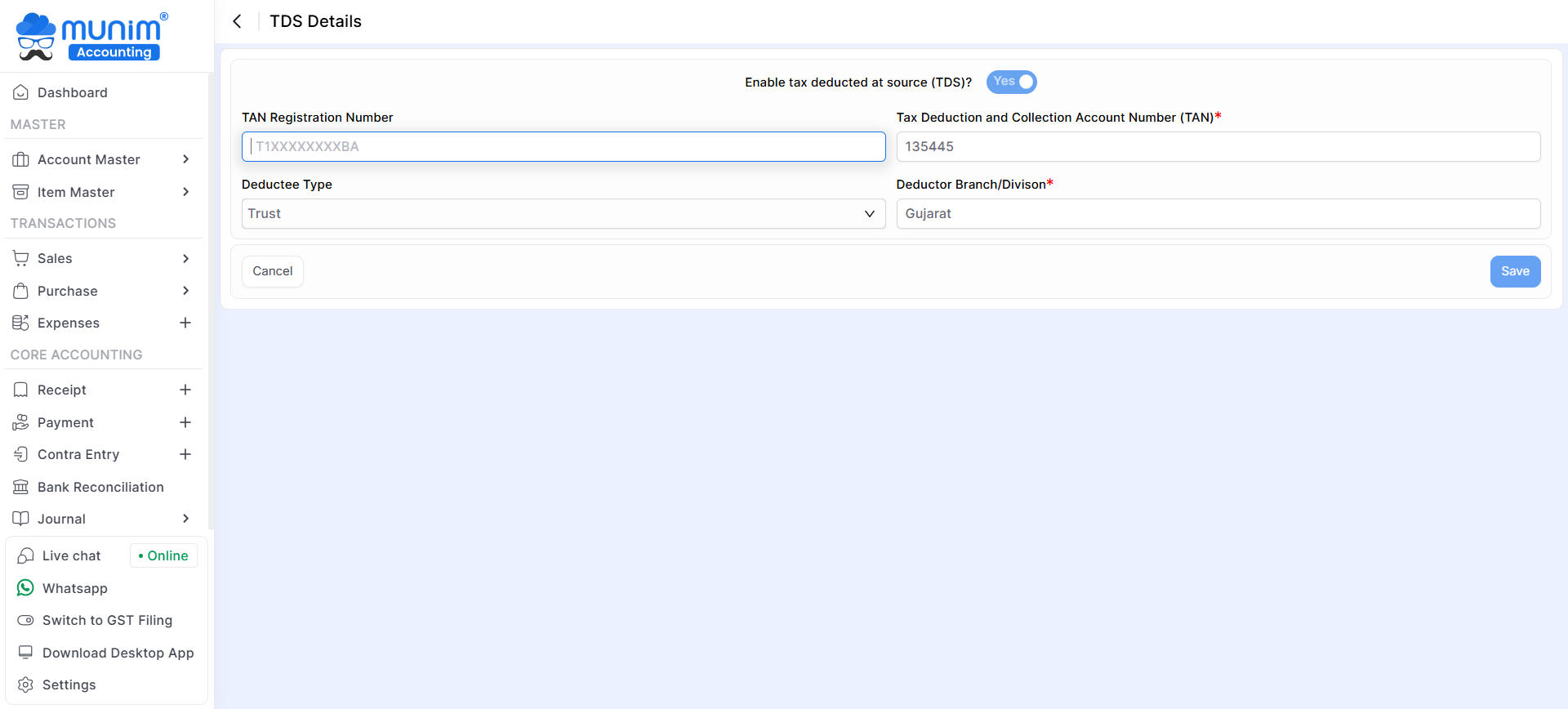

TDS Details

- Go to Settings > Statutory Information > TDS Details.

Here Enable Tax Deducted at Source (TDS)? If yes, then you are able to write TDS regarding data like TAN registration number, Tax deduction, collection account number(TAN), Deductee type, and Deductor branch/division.

If TDS is enabled, then our software can calculate the TDS amount.

TCS Details:

- Go to Settings > Statutory Information > TCS Details.

Here, Enable tax collected at source(TCS)? If yes, then you are able to write TCS regarding data like TAN registration number, Tax deduction, collection account number(TAN), Deductee type, and Deductor branch/division. Here also shows the TCS section list and the Selected TCS section list.

If TCS is enabled, then our software can calculate the TCS amount.