3081 views

3081 views Tax Collected at Source (TCS) is a statutory provision under the Income Tax Act where the seller collects tax from the buyer at the time of sale of specified goods or transactions.

Munim allows you to configure and apply TCS in your invoices and transactions.

Follow the steps below to enable and use TCS in Munim:

Step 1: Enable TCS in General Settings

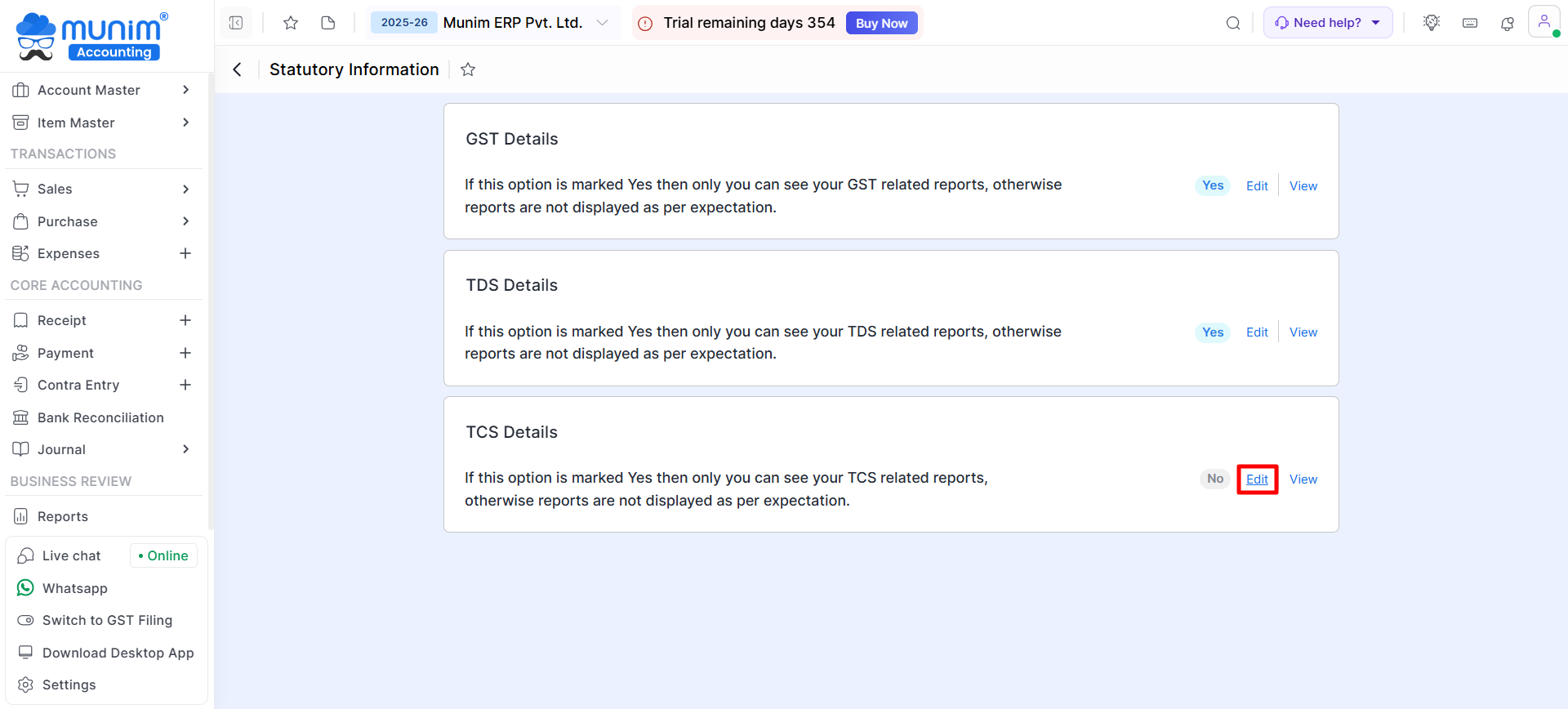

- Go to Settings > Statutory Information > TCS Details. Click Edit here.

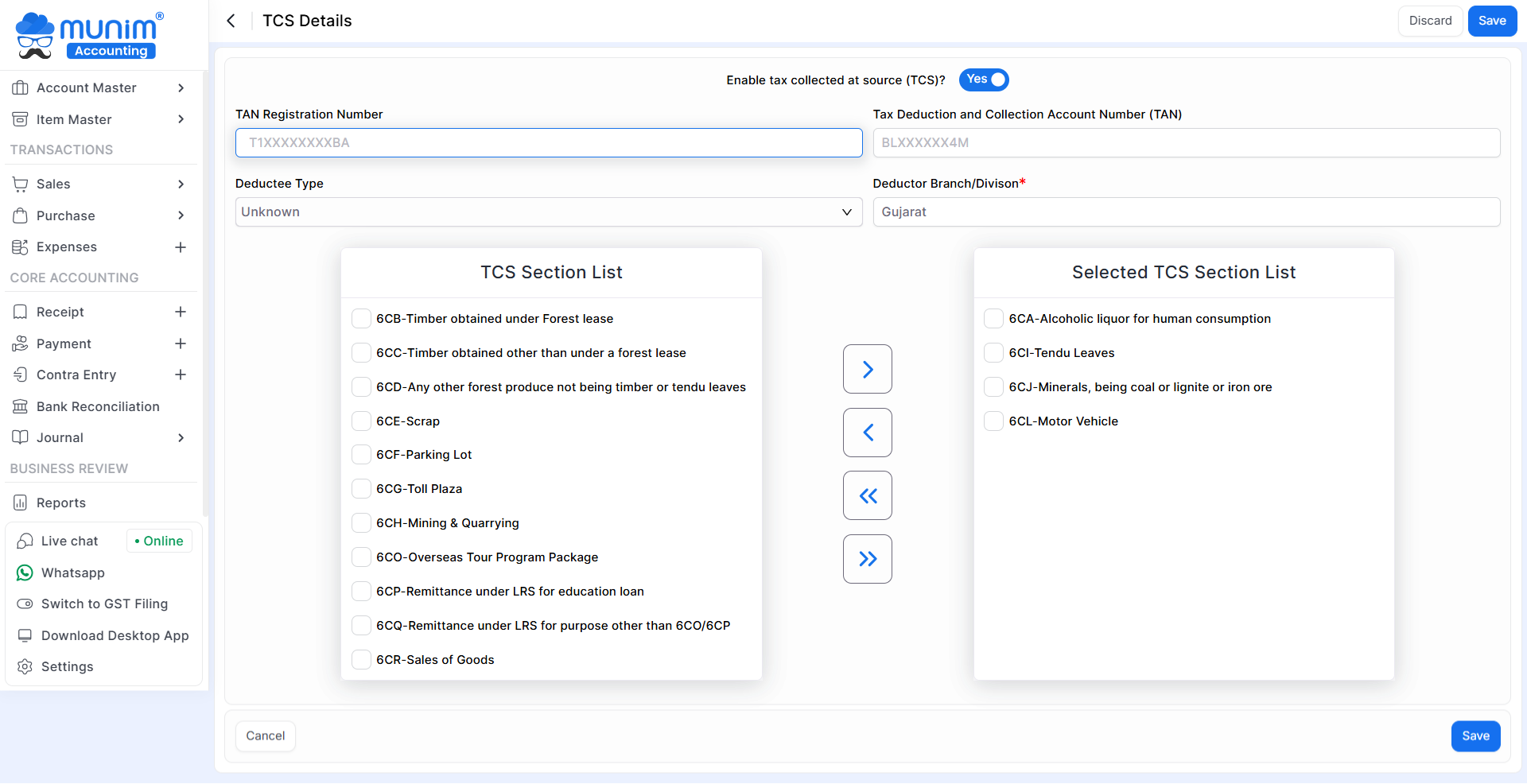

- Enable the option Tax Collected at Source (TCS)? by selecting Yes.

- Enter statutory details such as TAN, Collector Type, and Address.

- Here, you can select the required TCS sections to be used in transactions from the TCS section list.

- Click Save to continue.

Step 2: Enable TCS for a Customer

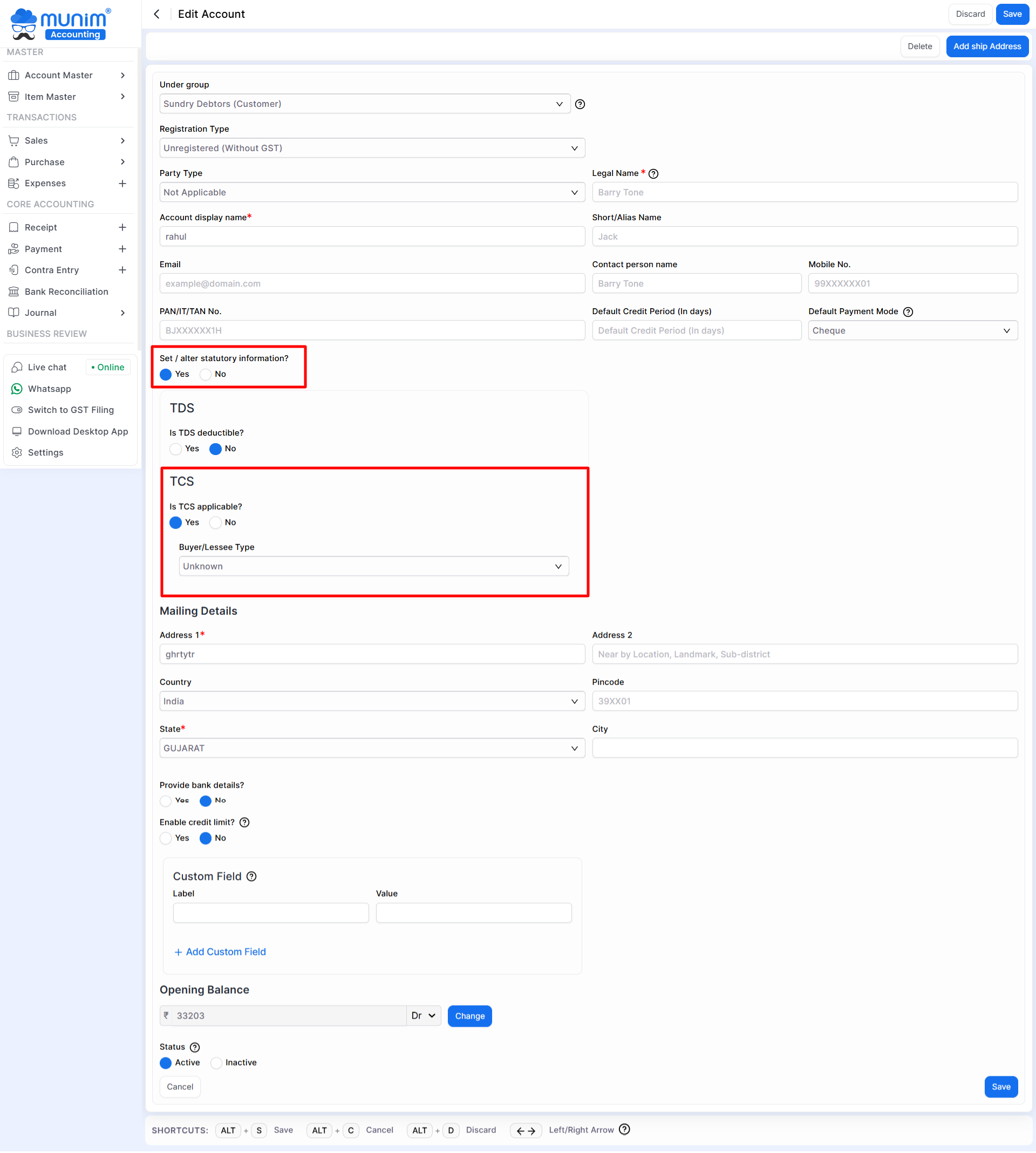

- Navigate to Account Masters > Account.

- Here search customer and Edit the customer account.

- In the statutory information section, enable Set / alter statutory information? → Yes.

- Here, Turn on Is TCS applicable? by selecting Yes.

- Add Buyer Type and Save changes.

Step 3: Apply TCS in Sales Invoices

- While creating a Sales Invoice, select the TCS-enabled customer.

- In the invoice entry page, choose the correct TCS section from the dropdown.

- TCS will be automatically calculated and added to the invoice.

Step 4: Apply TCS in Purchase Bills (if applicable)

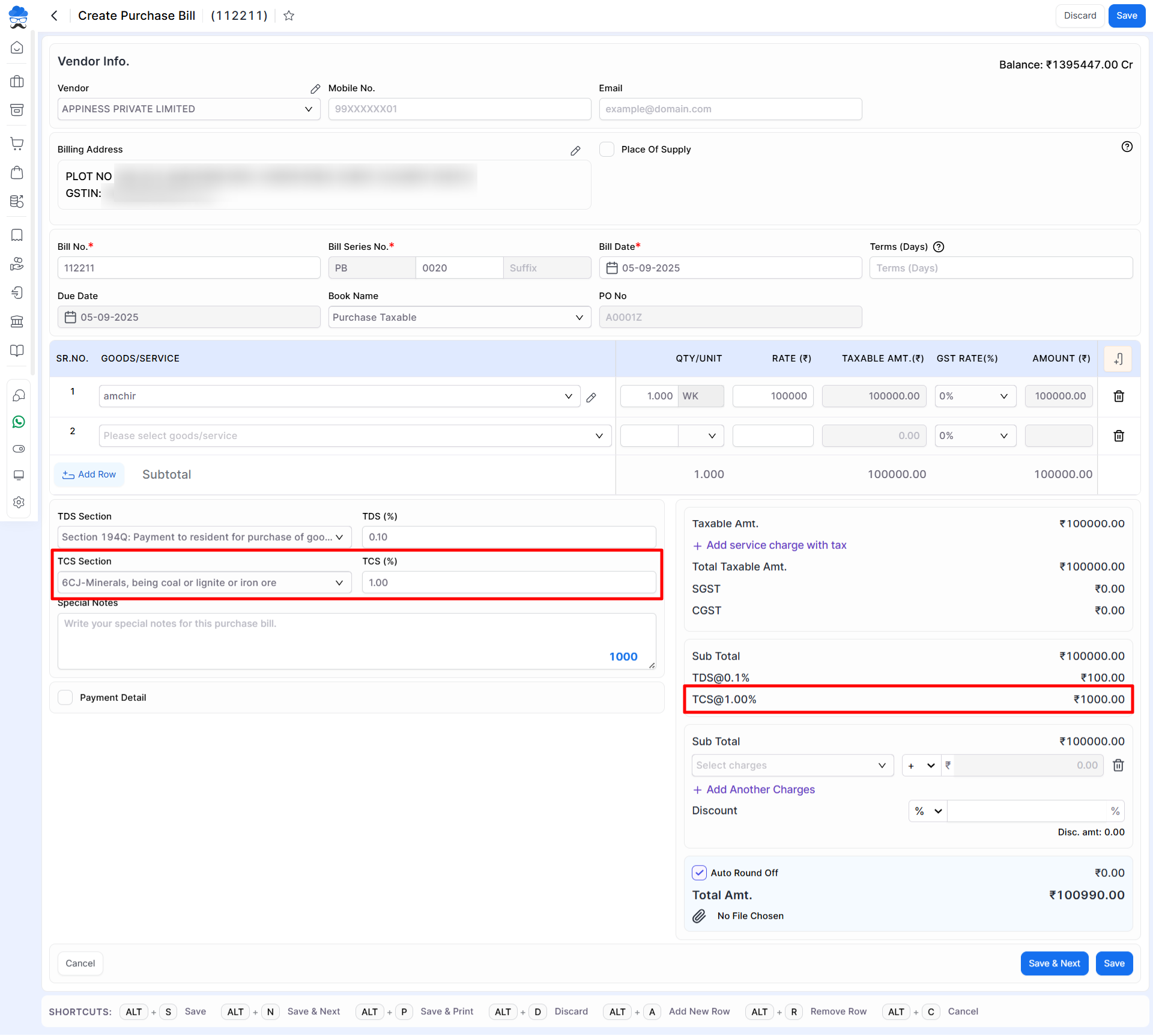

- While creating a Purchase Bill, select a TCS-enabled vendor.

- Add required fields and then choose the TCS section in the bill.

- TCS will be calculated as per the selected TCS Section.

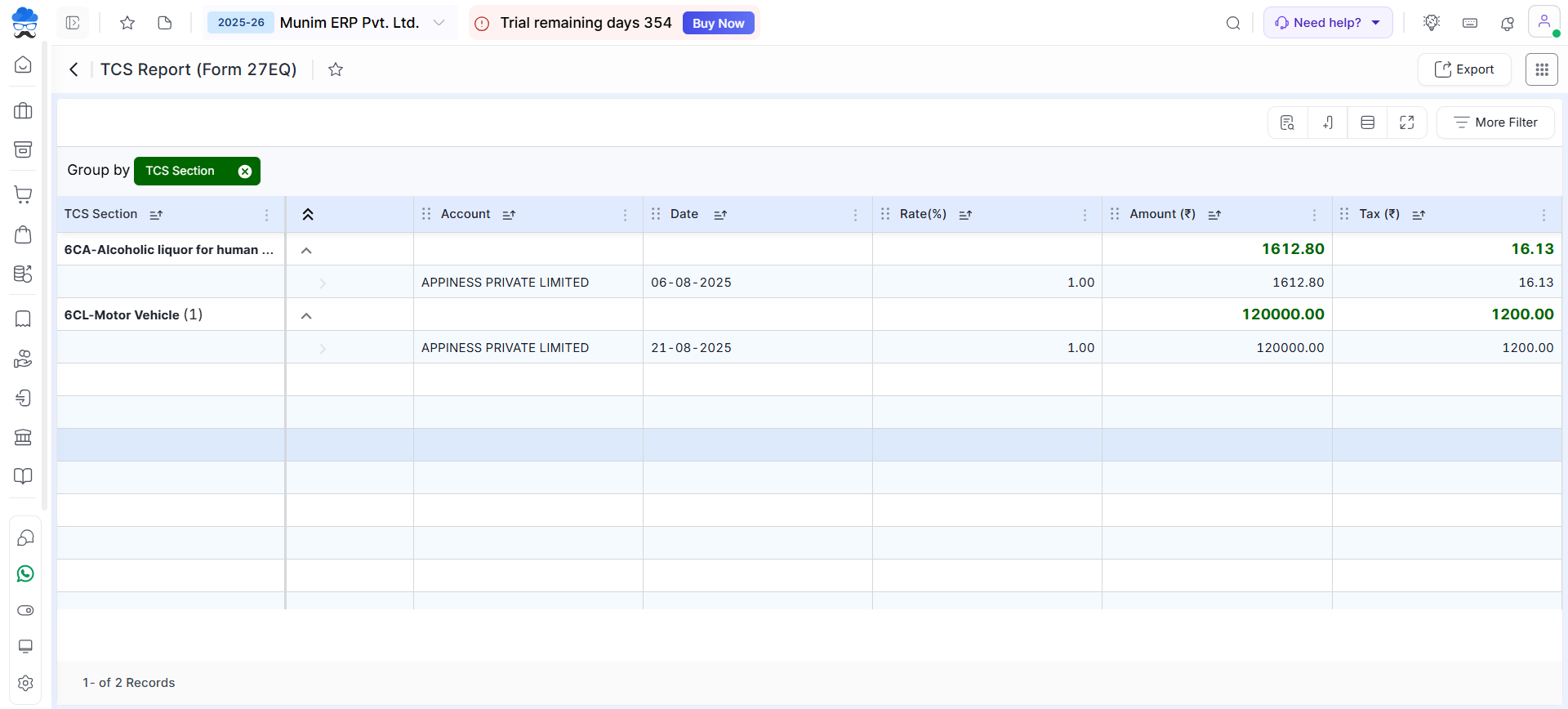

Step 5: View TCS Reports

- Go to Reports > Statutory Report > TCS Report.

- Check all TCS collections and liabilities section-wise and customer-wise with Rate and Tax Amounts.

Commonly Used TCS Sections (with Thresholds and Rates)

| Section | Nature of Transaction | Threshold Limit | TCS Rate* |

|---|---|---|---|

| 206C(1H) | Sale of Goods (if turnover > ₹10 Cr in previous FY and receipts from a buyer exceed ₹50 Lakh in current FY) | ₹50,00,000 per buyer | 0.1% (if PAN available), 1% (if PAN not available) |

| 206C(1F) | Sale of Motor Vehicle (value > ₹10 Lakh per vehicle) | ₹10,00,000 | 1% |

| 206C(1G) | Foreign Remittance under LRS / Overseas Tour Packages | Above specified limit (₹7 Lakh for remittance) | 5% / 20% (varies by purpose) |

| 206C(1) | Sale of Specific Goods (e.g., Alcohol, Timber, Scrap, etc.) | No threshold (applies on first rupee) | 1% to 5% depending on item |

*Rates are subject to change as per government notifications. Always verify before applying.

Important Notes

- Ensure TCS is enabled in both Statutory Settings and Customer Account.

- Always select the correct section in the invoice to avoid compliance issues.

- Reports can be exported from Munim for filing TCS returns.

This ensures compliance with TCS provisions while using Munim Accounting Software. If you need further assistance, review the provided instructions or contact Munim support for guidance.