566 views

566 views You can easily update or change the GST tax rate and set New MRP rate for any item in Munim Accounting software. Follow the steps below:

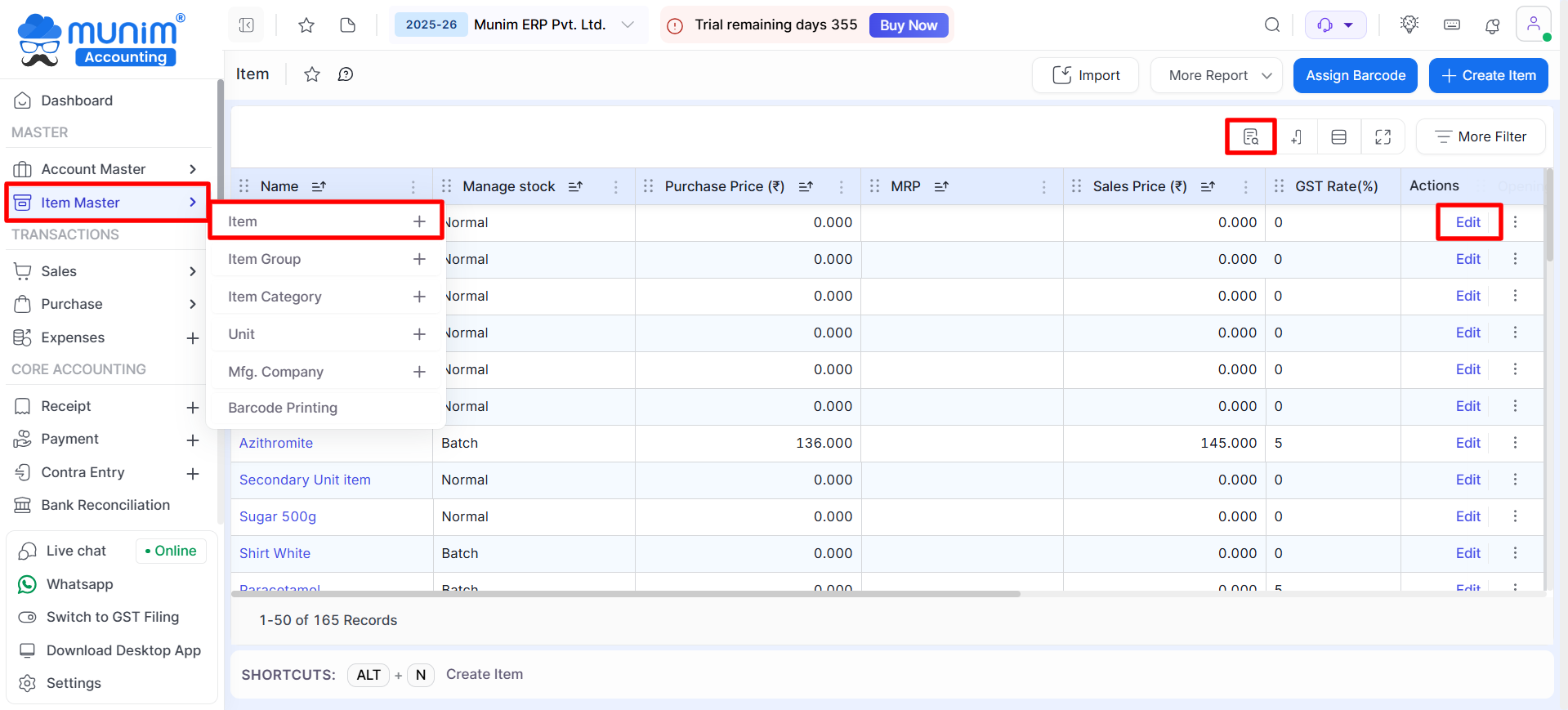

Step 1: Go to the Items Module

- Log in to Munim Accounting software.

- From the left-side menu, open Item Master > Item module.

- You will see the list of all items here.

+−⟲

Step 2: Search and Edit Item GST Rates and MRP details

- On the Item list page, Use the Show Column search option to open the search field to find the item you want to update one by one.

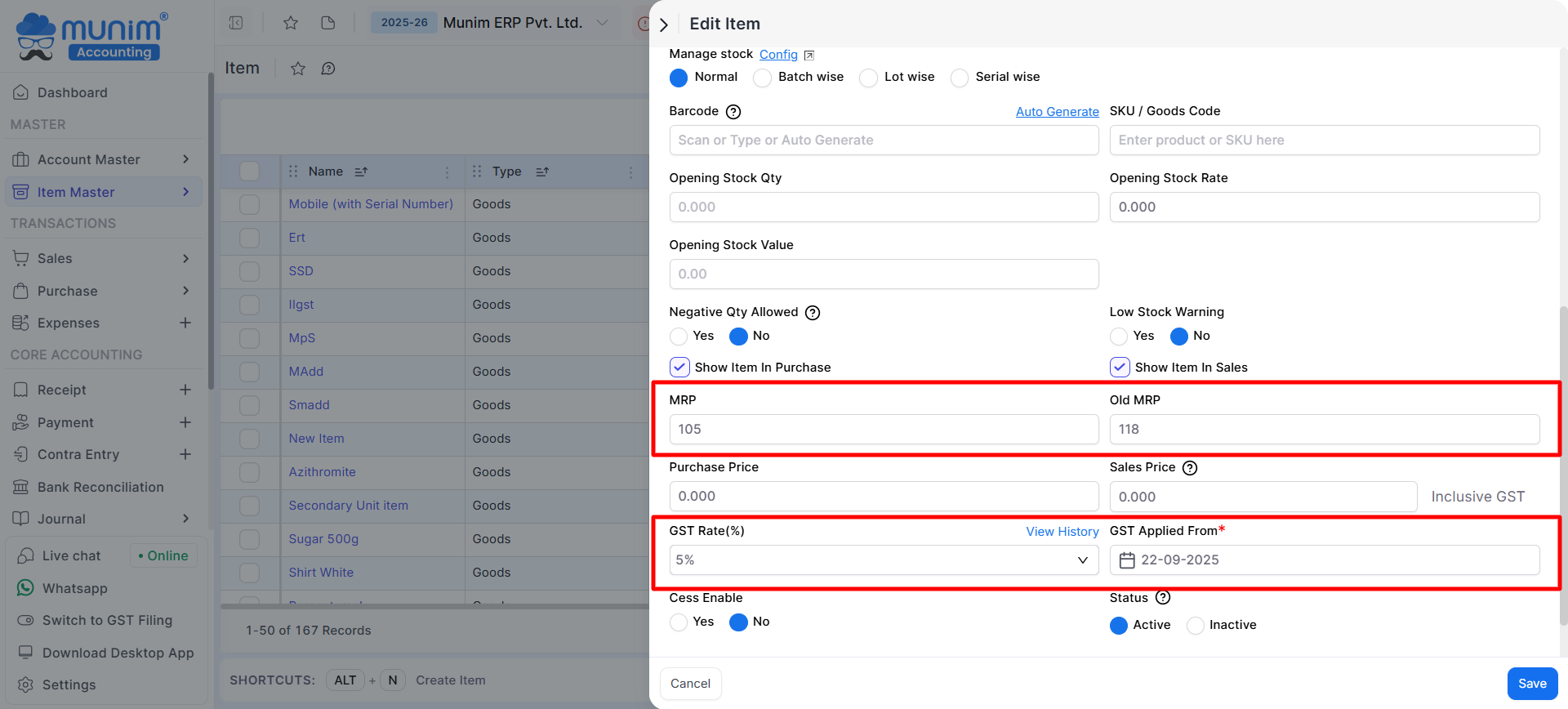

- Find the item and click on Edit for that item to open the sidebar with all details.

- In the Item Details form, scroll down to the tax and rate section.

- Find the GST Rate (%) field. Enter the new GST rate as per the government notification.

- Example: Change from 12% to 5%.

+−⟲

- On changing the tax rate, you must select the GST Applied from Date. Also, update the MRP and Old MRP fields and then click on Save.

- The updated GST rate and MRP will apply to all future invoices and purchase bills from the date the GST change is applied.

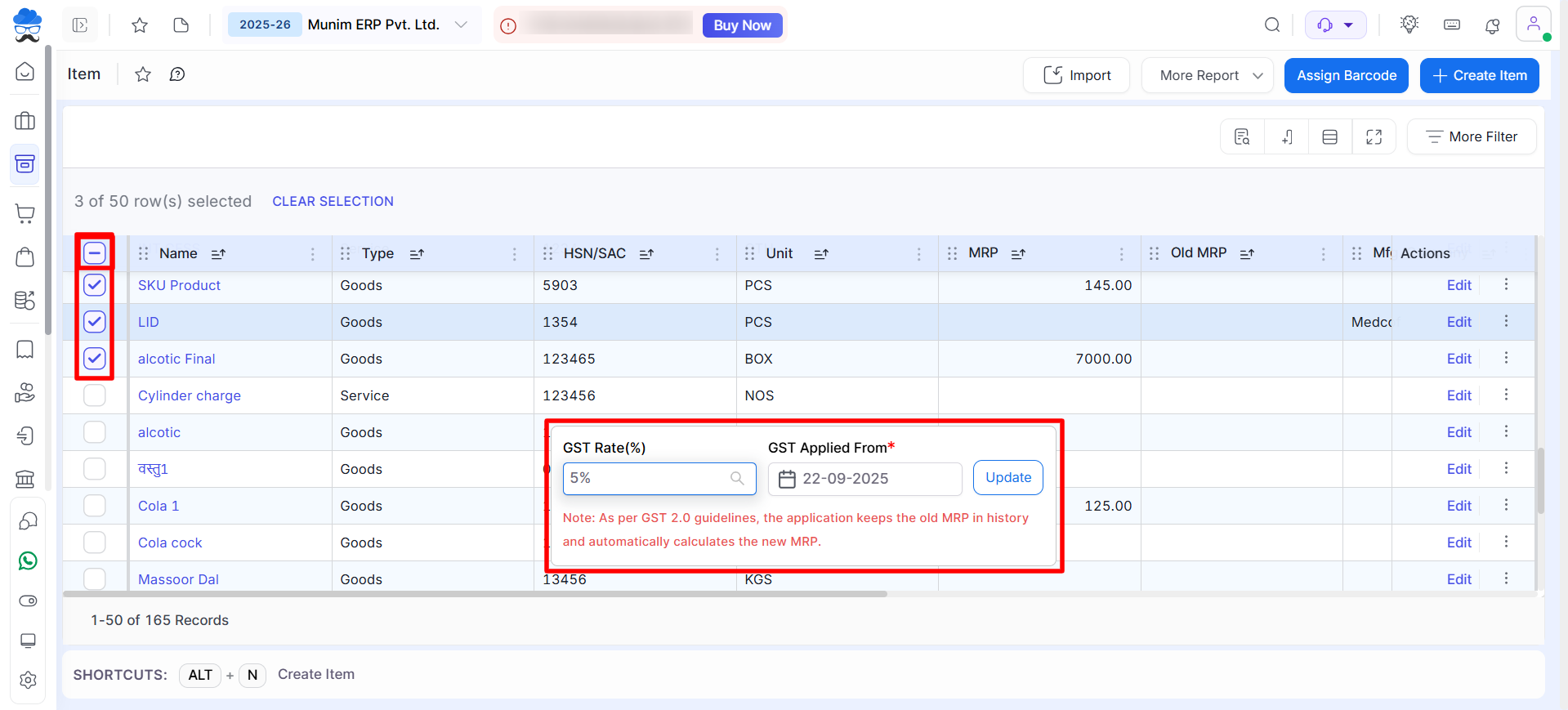

Step 3: Update Items GST Rate in Bulk

- You can also update GST rate and MRP data in bulk by going to Master > Item Master > Item.

- When updating the GST rate, it is required to select each product one by one or select all at once to ensure that the correct tax rate is applied to each item in your inventory.

- Now, in the pop-up below, input the desired GST Rate for the chosen product and select the GST Applied From Date, which is by default selected as per the recent rate change date.

- If the MRP for the items has been previously entered, the system will automatically adjust the MRP according to the new GST rate and record the previous MRP in the Old MRP field. The Old MRP will also be displayed on the printed output.

- Now click on the ‘Update‘ button to save the changes, and all selected items’ GST rate has been updated successfully.

+−⟲

Important Notes

- Existing transactions will not be affected.

- While printing, both the New MRP and Old MRP will be displayed in the MRP column.

- The new rate and MRP will apply only to new entries, based on the Applied From date.

- Repeat the process for each item that requires a GST Rate and MRP update.

For any help or assistance, please reach out to our Support team. We are here to guide you through any questions or issues you might encounter while using Munim.